Informacje o artykule

DOI: https://www.doi.org/10.15219/em104.1653

W wersji drukowanej czasopisma artykuł znajduje się na s. 4-13.

Pobierz artykuł w wersji PDF

Pobierz artykuł w wersji PDF

Abstract in English

Abstract in English

Jak cytować

Zborowski, M., & Chmielarz, W. (2024). Identification of awareness of the conditions for using cryptocurrencies in Poland. e-mentor, 2(104), 4-13. https://doi.org/10.15219/em104.1653

E-mentor nr 2 (104) / 2024

Spis treści artykułu

- Abstract

- Introduction

- Literature review

- Method

- Characteristics of the research sample

- Analysis and discussion of the findings

- Conclusion

- References

Informacje o autorach

Identification of awareness of the conditions for using cryptocurrencies in Poland

Marek Zborowski, Witold Chmielarz

Abstract

The primary aim of this article is to identify internet users' knowledge and awareness of cryptocurrencies and the determinants of their use in Poland. The study, which used the CAWI (Computer-Assisted Web Interview) method, was conducted on a group of 400 active Internet users selected through random and purposive sampling. In the survey, which was carried out in April/May 2022 in Poland, respondents were asked to evaluate cryptocurrencies taking into account the following criteria: familiarity with the concept of cryptocurrency, sources of information about the phenomenon, investment preferences, security awareness, and the respondents' knowledge of the advantages and disadvantages of cryptocurrencies. As a continuation of previous research undertaken in this area, the research demonstrated a strong understanding of the respondents concerning the lack of transparency associated with cryptocurrencies and the cryptocurrency market. The main concerns when using cryptocurrencies are: lack of protection against speculators, lack of supervision by a reputable financial institution, and lack of control of the cryptocurrency market by the National Bank of Poland (NBP). The conclusions and recommendations contained in this article may contribute to increasing knowledge and awareness of the phenomenon analysed, and increasing its popularity in society. Additionally, it provides insights for investors regarding the direction of cryptocurrency development.

Keywords: cryptocurrencies, awareness of cryptocurrency determinants, cryptocurrency usage factors, cryptocurrency characteristics, advantages of cryptocurrencies, disadvantages of cryptocurrencies

Introduction

Although cryptocurrencies are rapidly gaining recognition and usage in Poland, particularly among younger internet users, there are still conflicting opinions on the conditions of their use and the possibilities of using them. For this reason, a study was conducted to identify and evaluate the awareness of the existence and determinants of cryptocurrency use in Poland's economic reality. This study complements the authors' long-standing analysis of the online banking market and societal perceptions of new technologies (Chmielarz & Zborowski, 2020; Zborowski & Szumski, 2020).

The definition of cryptocurrency characterises it as "a virtual currency that is a specific means of exchanging value between its issuer and users" (Marszałek, 2019, p. 109). Its increasing use is mainly possible thanks to the Internet and the solutions built on it: e-commerce and e-banking (Chen & Wu, 2009; Ertz & Boily, 2019), and it is also seen as a financial innovation (Massó et al., 2021; Nieradka, 2018). This phenomenon presents several advantages, enabling the cheapest domestic and foreign transfer transactions, quick execution of funds transfer, independence from state governments and banking systems, use without currency exchange, convenient use, processing of transactions without intermediaries, a significant reduction in currency conversion time, cross-border use, transaction security (in an IT context, using blockchain technology), anonymity of transactions, and protection against control by state institutions. However, it also raises concerns that contradict these benefits, such as: lack of control by financial institutions, lack of control by central banks (money supply), lack of state guarantees regarding the stability and value of cryptocurrencies, high susceptibility to speculation, lack of trust in the business context (investors), attractiveness for criminals - anonymity, speed and lack of control and legal regulations.

The concept of cryptocurrencies and the possibility of their use also raise technological issues concerning blockchain (Wikarczyk, 2019) and distributed ledger (Piech, 2017; Przyłuska, 2016) as well as economic (Sierpiński, 2017) and legal concerns (Homa, 2015).

Research conducted by the Polish Economic Institute shows that 11.7% of Poles of working age declare that they have cryptocurrencies, 94.2% of respondents have heard of their existence, 83% of respondents agree with the statement that investing in cryptocurrencies involves a significant risk of losing funds, and 80% of respondents have purchased cryptocurrencies using centralised intermediaries (Łukasik & Witczak, 2023).

Undoubtedly, this new type of electronic payment based on new technological solutions is gaining popularity. Along with enthusiasm, the introduction of new technologies often faces social resistance due to a lack of understanding and awareness of their potential benefits. As stated in studies by national financial institutions: "New technologies can be viewed with apprehension, but technological progress cannot be restricted due to a lack of sufficient knowledge about them" (Piech, 2017, p. 9). When analysing the potential for the development of cryptocurrency usage in Poland, it is important to consider the perspective of awareness of the existence of such possibilities among potential users.

Therefore, in a way, investigating this area seems a natural prerequisite for increasing knowledge and awareness among the public, although, at the same time, the literature analysis carried out in section two (Chmielarz & Zborowski, 2018; Ertz & Boily, 2019; Huang et al., 2022; Kim, 2021) indicates that there is a research gap in this area. Our study aims to address this gap, and although it may not be possible to fully fill it given the extent and relevance of the problem, our goal is to at least reduce it.

To achieve this, the following structure of the paper was adopted. The next section analyses the literature on cryptocurrencies, as well as the awareness of their existence and use. The third section deals with the research methods used to investigate the issue, in particular the research procedure and the characteristics of the research sample. The fourth section presents analysis and discussion of the results obtained from the research sample. The final section provides a summary, draws conclusions, highlights the limitations of the study, and provides recommendations for further research in this area.

Literature review

The literature presents several perspectives on the issue undertaken in this study. An important aspect to consider is the analysis of how the perception of cryptocurrencies changed in the context of the COVID-19 pandemic's emergence. The article (Huang et al., 2022) refers to a strong factor shaping users' behaviour, i.e. the COVID-19 pandemic, showing that during uncertain economic conditions, such as the post-pandemic period, cryptocurrency assets can provide comparable benefits to those seen during more stable economic periods, such as the time before the COVID-19 pandemic, regarding diversifying investment portfolios. Another study (Kim, 2021) proved that during and after the COVID-19 pandemic, consumers are more likely to use Bitcoin - the most recognised cryptocurrency. The study considered factors such as antecedents (i.e. perceived behavioural control, subjective norm and financial self-efficacy) and consequence of use (i.e. behavioural intention to use Bitcoin), as well as consumers' overall attitudes towards money (i.e. power-prestige, retention time, distrust, quality and anxiety). There were also other studies (Nkrumah-Boadu et al., 2022), which included an examination of the correlation between cryptocurrencies and selected stock markets in Africa, and gold returns before and during the COVID-19 pandemic. The research showed, in addition to confirming that the COVID-19 pandemic had an impact on financial markets, that in the markets studied, selected cryptocurrencies were given little consideration in terms of diversifying investment portfolios, or perceiving them as a safe haven for funds or a form of security.

Another important factor in recognising the issue of cryptocurrencies and, more broadly, blockchain technology is its security. In the article (Navamani, 2023), the author pointed out that the issue of privacy and security of both identified and anonymous users is important, and cannot be overlooked in the context of its widespread use.

When considering cryptocurrencies, it is important to recognise the role of technology adaptation, for example investigating the factors influencing the propensity to use cryptocurrency. The research on the perception of the use of this technology in the case of the tourism industry (Treiblmaier et al., 2021) considered factors such as legislation and regulation, cryptocurrency acceptance, security, usability and costs, and found that factors contributing to the acceptance of the technology were: novelty, ease of use, safety and reliability, hedonic aspects, and trust. On the other hand, factors that negatively affected satisfaction included poor usability, low performance, volatility, and insecurity.

Similar studies (Arli et al., 2021) examined how knowledge of cryptocurrencies, the speed of transactions, and trust in the government affect trust in the solution under analysis and, consequently, loyalty to banks. In a similar manner, there are studies (Owusu Junior et al., 2020) indicating that gold and cryptocurrencies can help protect (hedge) investors against negative price movements of other conventional assets such as oil, fiat currencies or commodities.

A study of perceptions of the cryptocurrency issue was also conducted with the participation of undergraduate students in Portugal (Almeida & Costa, 2023), with the study sample consisting of 196 undergraduate students enrolled in six courses in the area of engineering and social sciences. Analyses of the results showed that the overall level of financial literacy is heterogeneous, and that the acquisition of knowledge about financial solutions takes place through both official and unofficial channels. Additionally, it was found that awareness of cryptocurrency knowledge is high, while recognition of cryptocurrency exchanges (acquisition portals) remains low.

Research covering the Malaysian market (Sukumaran et al., 2023), seen as a pioneer in the implementation of cryptocurrency, considered the innovation diffusion model. Theoretical factors, such as compatibility, relative advantage, testability, ease of use and observability, were compared with elements of the consumer behaviour theory. The study focused on the perceptions of retail investors in the context of their perception of the risk of bringing value. The research above showed that compatibility, testability, ease of use, observability and perceived value have a significant impact on the intention to invest in cryptocurrencies. However, the impact of relative advantage and perceived risk associated with the intention to invest in cryptocurrencies is not as significant.

The COVID-19 pandemic had a significant impact on the cryptocurrency market. For example, in 2020, the lowest price of Bitcoin was around USD 5,000, while after the crisis caused by the COVID-19 pandemic and the introduction of restrictions leading to the closure of global markets, the price of this cryptocurrency increased to USD 12,000 in August (Spyra, 2020). The changes concerned not only Bitcoin but also the entire cryptocurrency market, where their capitalisation increased. Cumulatively, in mid-November 2021, the market value reached USD 2.9 trillion, and, later, there was a correction in the entire cryptocurrency market (Maciejasz & Poskart, 2022).

The literature analysis suggests that cryptocurrencies are not yet considered to be on the same level as other assets, whether fixed or financial. Furthermore, there is still a significant level of unfamiliarity with cryptocurrencies themselves and the markets for their trading, while existing models investigating the level of technology adoption also appear to provide inadequate answers. These findings confirm the results of the literature studies cited in this article.

Method

Research procedure

Based on previous studies, the following research procedure was adopted, consisting of the following stages (Chmielarz & Zborowski, 2018; Zborowski & Szumski, 2020):

- conducting literature research and seeking expert opinions on the awareness of the perception of the cryptocurrency phenomenon in society,

- constructing the first version of the survey form based on the literature study, consultations, and own observations of the studied phenomenon,

- verifying the questionnaire in terms of comprehensibility and relevance of the questions, and carrying out a pilot study involving a randomly selected group of respondents,

- creating the final survey questionnaire,

- selecting, at random, student groups to carry out the final research,

- making the questionnaire form (CAWI method - Computer Assisted Web Interview) available to the previously selected student groups,

- collecting the survey results, analysing and discussing the findings,

- drawing conclusions and identifying future directions for the development of cryptocurrencies.

The survey questionnaire, which included nineteen questions, was grouped into three sections. The first part contained four questions related to the perception of cryptocurrencies. The second one, consisting of five questions, focused on assessing the characteristics of cryptocurrencies from the point of view of potential and actual users. The third part of the survey contained nine questions identifying factors that influence the use of cryptocurrencies. The last part contained questions related to demographic data.

Characteristics of the research sample

Data for the survey was collected at the University of Warsaw, at the Faculty of Management, in April/May 2022. It covered 653 people, of whom 400 filled out the survey questionnaire correctly and completely, representing more than 61% of the total sample. The survey was voluntary and covered randomly selected years of studies and student groups. Among the responses analysed in the study, more than 68% were sent by women and nearly 32% by men, which corresponds to the gender structure of the average economic university in Poland.

The second characteristic studied among respondents was age. Due to the type of university, and the random selection of student groups among full-time and part time (extramural and evening) studies, the age distribution was not particularly diversified. Nevertheless, due to the largest number of answers given by those in the first years of their studies, nearly 96% of the respondents were aged 19-24, and only a little more than 4% were older. However, it is important to indicate that the respondents belong to the group of users who are undoubtedly the most active and most open to innovations (Batorski, 2015). During the pandemic, this group was even more active with regard to using new ICT technologies (studying remotely, increased online shopping, banking operations carried out exclusively on the Internet, etc.). Education of the respondents was correlated with their age. Over 80% of respondents held a high school diploma, nearly 19% had a Bachelor's degree, and just over 1% had a graduate degree.

Table 1

Characteristics of the study sample

| Characteristics | % share |

| Gender | |

| Female | 68.09% |

| Male | 31.91% |

| Age | |

| 19-24 | 95.98% |

| 25-34 | 3.77% |

| 35-55 | 0.25% |

| Education | |

| Bachelor's degree, undergraduate | 18.84% |

| Secondary | 80.15% |

| Higher | 1.01% |

| Place of residence | |

| town with 21-50 thousand inhabitants | 11.81% |

| city with 51-200 thousand inhabitants | 5.53% |

| town with up to 20 thousand inhabitants | 6.78% |

| city with more than 200 thousand inhabitants | 57.54% |

| village | 18.34% |

| Field of study | |

| social sciences, including psychology, sociology, economics, pedagogy, administration and law | 93.97% |

| exact sciences, including mathematics, computer science, physics and chemistry | 5.78% |

| technical/engineering studies | 0.25% |

| Financial situation | |

| very good (I can afford everything I need, and I have some savings) | 17.59% |

| good (I have no reason to complain but it could be better) | 55.28% |

| sufficient (I can still make ends meet) | 3.52% |

| I am a student, and I am not financially independent | 7.79% |

| average (I have enough money to lead a frugal life) | 15.82% |

| Educational status | |

| I am a student and I don't work | 46.73% |

| I am a student and I do occasional work (a contract for a specific task/service contract) | 30.65% |

| I am a student and I work on the basis of a full-time or part-time employment contract | 21.86% |

| I am a student and I am self-employed | 0.76% |

| Professional status | |

| I am a student and I don't work | 46.73% |

| operators (e.g. machine operator, machine fitter, driver) | 1.01% |

| office workers/clerical staff (e.g. secretary, clerk) | 29.65% |

| semi-skilled/unskilled workers (e.g. porter, cashier) | 3.27% |

| service workers (e.g. seller, guide, sales representative) | 11.31% |

| farmers (e.g. breeder, grower, gardener, forester) | 1.51% |

| specialists (e.g. IT specialist, engineer, physician, teacher) | 3.52% |

| technicians (e.g. construction technician, IT technician) | 1.26% |

| senior staff (e.g. executive, manager) | 1.74% |

Source: authors' own work.

The majority of respondents are from large cities (over 58%) and rural areas (over 18%). Among the fields of study, almost all respondents study or have studied social sciences (nearly 94%). The remaining share, more than 6%, study mathematics, technology, and other fields.

The material situation of more than half of the respondents (55%) is self-assessed as good, and in the case of 18% of the sample it is assessed as very good. Nearly 16% of study participants consider their material situation to be average, and none of the respondents regards it as bad. This is probably due to the fact that more than 52% of students declare working on a casual basis and having a full-time or part-time employment contract. Judging from the declaration, nearly 8% are not financially independent. Around 39% of the sample do not admit to having additional sources of income or state that they live together with their parents.

The majority (47%) of respondents are primarily students or pupils, while the remainder work mainly as office workers (30%) or service sector employees (11%). Some respondents are employed as professionals or do simple jobs (more than 3% each).

Analysis and discussion of the findings

The survey results allowed the authors to evaluate the phenomenon of cryptocurrencies in the Polish financial market, as assessing public awareness of this phenomenon enables determination of the degree and potential for using modern blockchain-based information technologies to create a sustainable society in the future.

As a result of the survey mainly covering young people from the academic community, there was not a single person among them who had not heard of the cryptocurrency phenomenon prior to this study. Interestingly, most of them (70%) got their knowledge from the Internet, and 20% from friends. The remaining 10% of respondents reported learning about cryptocurrencies from various sources, while 3% declared hearing about it from relatives, almost 3% at university, over 2% from television and radio, and nearly 2% at work. The survey findings reveal some interesting insights, particularly regarding two sources of information that received low percentages. Firstly, university as a source of information scored poorly, which could indicate that there is a gap in the coverage of the latest technological phenomena in university programmes or by lecturers. The second low percentage was indicated in the case of TV and radio, which could suggest that either little attention is paid to cryptocurrencies in the content provided, or that programmes containing information about cryptocurrencies are not popular among the respondents.

It was assumed that "hearing" about a phenomenon does not mean fully understanding it. Therefore, the next question covered the definition of a cryptocurrency that most closely matched the respondent's perception. A total of four definitions randomly copied from the Internet (as the most important source of information about cryptocurrencies for respondents) were considered, with the responses fairly evenly distributed at the level of 20-30%, among which none had a significant advantage. Thus, the differences between matching definitions to the respondents' perception of cryptocurrency were not great, with a maximum of 12.8%. The results are shown in Table 2.

Table 2

Respondents' understanding of the concept of cryptocurrency

| Definitions of cryptocurrencies | Percentage share |

| Cryptocurrencies are an innovative form of "virtual coin" in a distributed ledger system with advanced cryptography lying at the core of its creation. It is a system that stores information about the status of a specific wallet, in pre-approved units of cryptocurrency. The security key in this case is a token, and the foundation of everything is blockchain technology. (SOCIAL. ESTATE, n.d.) | 31.9% |

| Cryptocurrencies - digital markers of value that are not issued by a central bank or public authority, nor are they pegged to fiat currency. They are widely accepted by individuals or legal entities as a means of payment, and can be transferred, stored, or sold electronically. (Komisja Nadzoru Finansowego, 2017) | 27.1% |

| Cryptocurrencies are built on a distributed accounting system that uses cryptography to store information about the state of ownership in contractual units. Ownership status is associated with individual nodes of the system, commonly referred to as "wallets". Only the holder of the corresponding private key has control over a given wallet, preventing double-spending, as each unit of currency can only be spent once. (Surdyk, 2018) | 21.9% |

| Cryptocurrencies are virtual money, created online with the help of cryptocurrency miners, which use strong cryptography to secure transactions. Based on the so-called proof of work. (Kryptowaluta, n.d.) | 19.1% |

Source: authors' own work.

The next question examined the knowledge of cryptocurrencies used in the Polish market. Out of the twenty-four cryptocurrencies listed by the survey authors and completed by respondents, the first ten comprise more than 87% of all responses. The findings are presented in the table below.

Table 3

Familiarity with cryptocurrencies on the Polish market among respondents

| Cryptocurrency | % responses |

| Bitcoin - BTC | 29.94% |

| Ethereum - ETH | 15.01% |

| Bitcoin Cash - BCH | 10.11% |

| Bitcoin Gold - BTG | 7.16% |

| Lisk - LSK | 6.79% |

| Dash - DASH | 6.26% |

| PIVX - PIVX | 3.85% |

| Litecoin - LTC | 3.24% |

| Golem - GNT | 2.79% |

| Zcash - ZEC | 2.11% |

| Total | 87.26% |

Source: authors' own work.

The next question was related to investing in cryptocurrencies. The survey results showed that a mere 12% of the respondents currently invest in cryptocurrencies, although what is particularly noteworthy is that over 70% of the respondents reported actively monitoring opportunities related to cryptocurrencies. This is reinforced by the fact that repetitive announcements by the central bank - the National Bank of Poland - and financial institutions (Uważaj na kryptowaluty, n.d.), as well as comments on the Internet (Uważaj na kryptowaluty, n.d.), point to the dangers and risks related to trading in cryptocurrencies. On the other hand, according to those surveyed, as many as 32% believe that cryptocurrencies are rather safe, and nearly 4% feel sure of this. Unfortunately, opinions about their potential danger are similarly distributed. The phrase that they are rather dangerous was chosen by 30% of respondents, while the assessment that they are definitely not dangerous was expressed by nearly 5%.

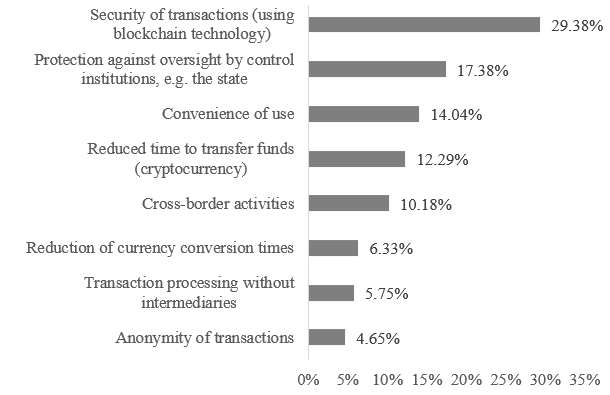

What motivates people to invest in cryptocurrencies? According to 29% of respondents, the most important advantage is the security of transactions, which is not surprising given the messages discussed above. This view almost aligns with the assessment of the security of such transactions, which underscores the significance of blockchain technology in ensuring safe and reliable transactions. In second place (17%) was the protection from scrutiny by regulatory institutions, such as the state, which is likely related to unfavourable regulations for investors in certain countries, and the anonymity provided by cryptocurrencies for transactions. In third place is the convenience of use (12%), which is specific to experienced users of online applications. Other factors driving investment in cryptocurrencies are highlighted in Figure 1.

Figure 1

Main advantages of cryptocurrencies

Source: authors' own work.

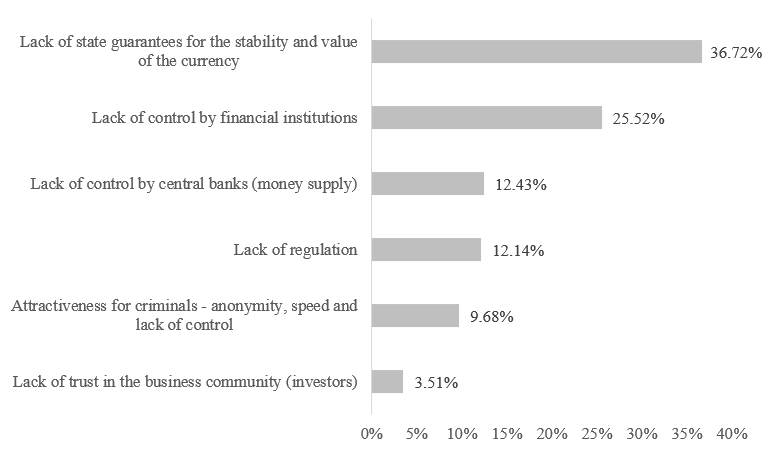

Understanding the factors that drive investments in cryptocurrencies also requires identifying the barriers that limit their widespread use. In this context, the most significant barrier (37% of responses) is the lack of state guarantees of the stability and value of cryptocurrencies. In second place (26%), the lack of control by financial institutions contributes to a lack of trust in this type of currency, which collectively accounts for more than 60% of negative determinants. Other barriers include the lack of control by banks and legal regulations, each accounting for 12% of responses, and respondents also identified the potential attractiveness of cryptocurrencies to criminals (10%) and lack of trust among investors (nearly 4%) as additional barriers to adoption (as shown in Figure 2).

Figure 2

Main disadvantages of cryptocurrencies

Source: authors' own work.

According to the respondents, the advantages and disadvantages of cryptocurrencies are primarily based on their observed characteristics. Although fast transfers were seen as the most important characteristic of cryptocurrencies by 42% of respondents, this advantage has not been fully recognised. The other characteristics evaluated by respondents align with the advantages of cryptocurrencies, with the second most important characteristic, according to 22% of respondents, being independence from governments and banking systems, which some consider a disadvantage. The economic aspect of enabling cheap transactions is rated next at 21%, anonymity, which is less specific and relevant to cryptocurrencies, was evaluated by 12% of respondents, while security, which is seen as less of an issue (or even taken for granted) in many financial systems, was rated by only 2% of respondents.

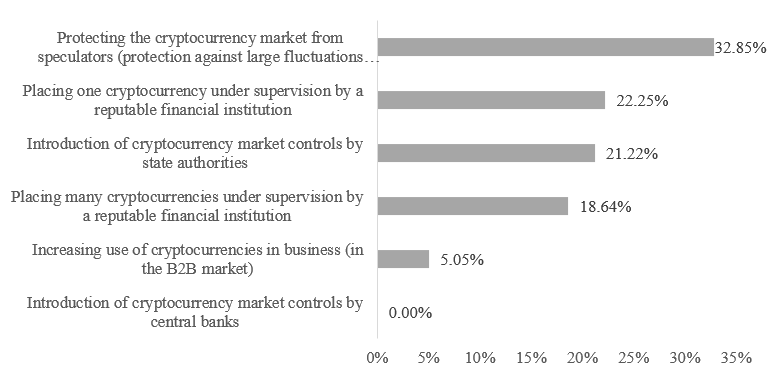

Despite the numerous advantages of cryptocurrencies, respondents show far-reaching skepticism when it comes to the widespread implementation of this technology on par with traditional currencies. The answer "never" was given by 23% of respondents, while, in contrast, more than 57% believe that they could be widely implemented and used similarly to fiat currencies in 10-20 years at the earliest, 16% believe this could take place in the next 20 years, and only around 3.5% believe it will happen in the near future. The skepticism surrounding the widespread use of cryptocurrencies is primarily due to the conditions that must be met for them to become a common means of payment, which are related to the security of cryptocurrency transactions. The most significant concern, according to 33% of respondents, is the protection of the cryptocurrency market from speculators to prevent large fluctuations in cryptocurrency prices. A further 22% of respondents believe that one cryptocurrency should be placed under the supervision of a reputable financial institution, while 21% of respondents believe that controlling the cryptocurrency market by state authorities or the inclusion of multiple cryptocurrencies under the supervision of a reputable financial institution could help. Respondents attach little importance to the increase in the use of cryptocurrencies in the B2B market, and they consider the introduction of control over the cryptocurrency market by the National Bank of Poland irrelevant, indicating deep distrust in the bank (as shown in Figure 3).

Figure 3

Conditions for the implementation of cryptocurrencies

Source: authors' own work.

The subsequent survey questions were aimed at determining further conditions, other than institutional, that could be established to accelerate the widespread adoption of cryptocurrencies in economic practice. The first factor was to examine the degree of awareness and popularity of the phenomenon among respondents. Overall, more than half of the respondents answered that they observe a general awareness of cryptocurrencies, and that they are popular in many social circles. At the same time, 33% expressed the opposite opinion, and 15% had no opinion on the topic. A logical continuation of these answers was the question concerning the reasons for the lack of popularity among the public, which showed that the primary problem (43% of responses) is a low level of knowledge of cryptocurrencies and how to use them, with slightly fewer responses opting for too few places where they can be used to pay for products or services. Much less important (14%) were information campaigns (especially from government agencies) pointing out the significant risks of using cryptocurrencies, rather than pointing out the potential benefits of using them. Just under 7% indicated limited access to cryptocurrencies as one of the concerns to be considered.

The second significant factor affecting the adoption of cryptocurrencies was their official recognition as a means of payment. In the case of this question, 48% of participants agreed with the statement ("rather yes") and an additional 10% (totalling 58%) responded "definitely yes". Conversely, 15% of respondents answered "rather not" or "definitely not" with reference to the existing reluctance to use cryptocurrencies. A notable 27% of respondents did not have an opinion on the matter.

If the use of cryptocurrencies involved the need to learn how to use them (participating in appropriate specialised courses), the share of those willing to use them would be even higher. Some 12% of respondents expressed their full approval for this idea, while as many as 58% said they would rather do so (a total of 70%). There were similar proportions of shares for the response options of "rather no" - 12% and "I don't know what I would do in such a situation" - 21%.

Based on the literature (Almeida & Costa, 2023), the influence of the respondents' environment, particularly those they hold in high regard, appeared to be a significant factor, although less critical than the previous ones. Only 35% of participants expressed their inclination to take advantage of this opportunity, and nearly 6% were certain to do so, totalling 41%. 24% of respondents expressed the opposite opinion, and a substantial 35% had no opinion on the matter.

The best results were obtained when using a combination of institutional and economic reasons, concluding that if there was recognition of cryptocurrencies by central banks and states as an official means of payment (parallel to a fiat currency), businesses would accept cryptocurrency payments, and their rates would be stable. This is reflected in the fact that as many as 26% of respondents would adopt cryptocurrency, and a further 59% expressed their partial approval of the idea - "rather yes" (85% in total). The percentage of answers of "definitely no" and "rather no" declined to a total of 5%, and the size of the undecided group declined to 12%.

Differences in the situation before the pandemic and after the official lifting of COVID-19 pandemic restrictions were also examined in light of the pandemic experience. The results are presented in Table 4.

Table 4

Differences in attitudes towards using cryptocurrencies before and after removing COVID-19 pandemic restrictions

| Response | Did you consider using cryptocurrencies before the COVID-19 pandemic? | After the COVID-19 pandemic restrictions were lifted, did you consider using cryptocurrencies? | Absolute difference |

| I don't know | 3.27% | 3.11% | 0.15% |

| Rather no | 41.21% | 33.38% | 7.83% |

| Rather yes | 12.06% | 25.36% | 13.30% |

| Definitely no | 35.68% | 21.37% | 14.31% |

| Definitely yes | 7.78% | 16.78% | 8.98% |

| Total | 100.00% | 100.00% |

Source: authors' own work.

The literature indicates (Huang et al., 2022) that the COVID-19 pandemic impacted the use of all innovative technologies, especially those related to remote operations conducted on the Internet. The above table clearly shows that the percentage of respondents who strongly refused to use cryptocurrencies decreased significantly (by 21%), and the share of people who stated that they would probably not use them also reduced (by 8%), which is undoubtedly connected with the participants' responses indicating that they would probably use them (an increase of 13%) and would definitely use them (9%). Prior to the pandemic, 77% of respondents did not consider using cryptocurrencies, while after it, only 55% took that approach. Although the indicators are still slightly above 50%, the 22% decrease indicates a growing trend in this respect.

Conclusion

The results obtained lead to the following conclusions:

- the purposive selection of the research sample - mainly among those in the 19-24 and 25-35 age range - resulted in a very high level of awareness of the concept of cryptocurrency in this study, which is also evidenced by the correct understanding of the definition of cryptocurrency, as verified in the survey,

- knowledge of cryptocurrencies used on the Polish market is high. Respondents listed 24 such currencies, the top three, that is Bitcoin - BTC, Ethereum - ETH and Bitcoin Cash - BCH, being indicated by more than 55% of respondents. In contrast to the previous survey (Zborowski & Szumski, 2020), Litecoin LTC fell to ninth place, and Ethereum ETH moved up one place. The continued attachment to the cryptocurrency family and its high recognition of Bitcoin is due to the appearance of the Bitcoin Cash cryptocurrency as the first one on the Polish market,

- similarly to the previous survey, knowledge of cryptocurrencies was obtained primarily from the Internet (70%) and from friends (10%),

- only around 10% of the respondents are not interested in investing in alternative currencies, although 70% closely monitor opportunities related to their use,

- nearly 1/3 of respondents believe that cryptocurrencies are rather safe, and almost 4% are certain of it (which dramatically changes the opinion from three years ago when 3/4 were afraid of investing in alternative currencies),

- respondents' opinions pointed to the fact that the advantages of cryptocurrencies were shaped similarly to the determinants of the use of cryptocurrencies - the most important being the security of transactions, protection from inspection by regulatory institutions, the third being the convenience of use,

- in this context, the statements on the barriers to their use were interesting - the most significant barrier - receiving more than one-third of the responses - was the lack of state guarantees for the stability and value of such currency and the lack of control by financial institutions and central banks, which was exactly the opposite of their advantages,

- however, nearly 1/4 of respondents believe - despite the advantages of cryptocurrencies - that they will never be equivalent to official currencies. This mainly stems from concerns about the lack of protection against speculators, the lack of supervision by a reputable financial institution, and the lack of control of the cryptocurrency market by the NBP,

- other determinants of the introduction of cryptocurrencies into general circulation are: the degree of awareness and popularity of the phenomenon among respondents; the desire to learn how to use them; their approval as an official means of payment; and the influence of the social environment. In these cases, respondents (35-85%) stated that they would support the introduction of a cryptocurrency market, although the best results approving the hypothetical introduction of cryptocurrencies would be achieved if a combination of institutional and social determinants occurred,

- the COVID-19 pandemic resulted in a twofold increase with regard to the approval for the use of cryptocurrencies (from 20% to 42%).

The survey results demonstrated that the respondents have a strong understanding of the lack of transparency associated with cryptocurrencies and the cryptocurrency market, and also revealed the factors that are important to the respondents when considering the adoption of cryptocurrencies, and the extent to which they prioritise these factors. Despite cryptocurrencies being a new and novel concept, the respondents showed a high level of familiarity with them, and were able to assess their specific attributes.

The results of this research can provide organisations looking to increase their investment participation in the cryptocurrency market, as well as those using cryptocurrencies in the market, with key information to support their initiatives.

The research had some limitations that should be noted. Firstly, the research sample was limited to the academic community. Secondly, the research was conducted in only one country. Thirdly, the research was restricted to the perspective of potential or actual users of cryptocurrencies, rather than considering the entire market, including the quality of tools such as cryptocurrency exchange websites. Fourthly, no comprehensive model approach has been developed as of yet that could be used in the study.

The above conclusions indicate the upcoming research directions for this problem, with the survey results stressing the need for further investigation into the factors that support the development and application of the solutions discussed in the article. To accomplish this, researchers could consider expanding the sample size, analysing and evaluating online portals that serve the cryptocurrency market both domestically and internationally, or building a model to understand the societal adaptation of this technology.

Given the preceding discussion, it is important to create a framework model of the logical impact of individual factors on the emergence of cryptocurrencies in the Polish market. The elements of such a model indicated by the respondents could include:

- psychosocial factors: the popularity and awareness of cryptocurrencies, the social environment of users,

- institutional and economic factors: recognition of cryptocurrencies as an official currency, recognition of cryptocurrencies by central banks and states as an official means of payment (parallel to a standard, fiat currency), entrepreneurs would accept payments with cryptocurrencies and their rates would be stable,

- educational factors: acquiring knowledge about cryptocurrencies and how to use them,

- random events: pandemic, war, natural disaster, etc.

The relationships between the various factors are complex, very often depending on unpredictable external factors such as: economic policy, the balance of political power, dominance of particular political fractions, relations with neighbouring states, etc. Given the financial nature of cryptocurrencies and their numerous connections with the world of state administration and political authorities, the framework model for their adaptation in Poland should consider unique conditions that differ from the most commonly used adaptation models such as TAM (Davis, 1985; Venkatesh & Davis, 2000), UTAUT (Williams et al., 2015), UTAUT2 (Alalwan et al., 2018; El-Masri & Tarhini, 2017; Morosan & DeFranco, 2016), or TRA (Almajali et al., 2022), and requires further comprehensive and detailed investigation.

References

- Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., & Algharabat, R. (2018). Examining factors influencing Jordanian customers' intentions and adoption of internet banking: Extending UTAUT2 with risk. Journal of Retailing and Consumer Services, 40, 125-138. https://doi.org/10.1016/j.jretconser.2017.08.026

- Almajali, D. A., Masa'deh, R., & Dahalin, Z. M. (2022). Factors influencing the adoption of Cryptocurrency in Jordan: An application of the extended TRA model. Cogent Social Sciences, 8(1), 2103901. https://doi.org/10.1080/23311886.2022.2103901

- Almeida, F., & Costa, O. (2023). Perspectives on financial literacy in undergraduate students. Journal of Education for Business, 98(1), 1-8. https://doi.org/10.1080/08832323.2021.2005513

- Arli, D., van Esch, P., Bakpayev, M., & Laurence, A. (2021). Do consumers really trust cryptocurrencies? Marketing Intelligence & Planning, 39(1), 74-90. https://doi.org/10.1108/MIP-01-2020-0036

- Batorski, D. (2015). Technologies and media in households and lives of Poles. Contemporary Economics, 9(4), 367-389.

- Chen, L., & Wu, H. (2009). The influence of virtual money to real currency: a case-based study. 2009 International Symposium on Information Engineering and Electronic Commerce (pp. 686-690). https://doi.org/10.1109/IEEC.2009.150

- Chmielarz, W., & Zborowski, M. (2018). The Awareness of the Internet of Things Among Polish Students. EDULEARN18 Proceedings. 10th International Conference on Education and New Learning Technologies (pp. 215-225). https://doi.org/10.21125/edulearn.2018.0123

- Chmielarz, W., & Zborowski, M. (2020). The Selection and comparison of the methods used to evaluate the quality of e-banking websites: the perspective of individual clients. Procedia Computer Science, 176, 1903-1922. https://doi.org/10.1016/j.procs.2020.09.230

- Davis, F. (1985). A technology acceptance model for empirically testing new end-user information systems: theory and results. Massachusetts Institute of Technology.

- El-Masri, M., & Tarhini, A. (2017). Factors affecting the adoption of e-learning systems in Qatar and USA: Extending the Unified Theory of Acceptance and Use of Technology 2 (UTAUT2). Educational Technology Research and Development, 65(3), 743-763. https://doi.org/10.1007/s11423-016-9508-8

- Ertz, M., & Boily, É. (2019). The rise of the digital economy: Thoughts on blockchain technology and cryptocurrencies for the collaborative economy. International Journal of Innovation Studies, 3(4), 84-93. https://doi.org/10.1016/j.ijis.2019.12.002

- Homa, D. (2015). Sekrety Bitcoina i innych kryptowalut. Jak zmienić wirtualne pieniądze w realne zyski. Helion, Onepress.

- Huang, X., Han, W., Newton, D., Platanakis, E., Stafylas, D., & Sutcliffe, C. (2022). The diversification benefits of cryptocurrency asset categories and estimation risk: Pre and post Covid-19. The European Journal of Finance, 29(7), 800-825. https://doi.org/10.1080/1351847X.2022.2033806

- Kim, M. (2021). A psychological approach to Bitcoin usage behavior in the era of COVID-19: Focusing on the role of attitudes toward money. Journal of Retailing and Consumer Services, 62, 102606. https://doi.org/10.1016/j.jretconser.2021.102606

- Komisja Nadzoru Finansowego. (2017, July 7). Komunikat Narodowego Banku Polskiego i Komisji Nadzoru Finansowego w sprawie "walut" wirtualnych. https://www.knf.gov.pl/o_nas/komunikaty?articleId=57363&p_id=18

- Kryptowaluta. (n.d.). Encyklopedia Zarządzania. Retrieved April 26, 2023, from https://mfiles.pl/pl/index.php/Kryptowaluta

- Łukasik, K., & Witczak, J. (2023). Popularność kryptowalut w Polsce. Polski Instytut Ekonomiczny. https://pie.net.pl/wp-content/uploads/2023/09/PIE-Raport_kryptowaluty_2023.pdf

- Maciejasz, M., & Poskart, R. (2022). Percepcja kryptowalut przez młodych uczestników rynku finansowego na przykładzie Polski i Niemiec. Bank i Kredyt, 53(6), 625-650.

- Marszałek, P. (2019). Kryptowaluty - pojęcie, cechy, kontrowersje. Studia BAS, 1(57), 105-125. https://doi.org/10.31268/StudiaBAS.2019.06

- Massó, M., Shevchenko, A., & Abalde-Bastero, N. (2021). Technological and socio- institutional dimensions of cryptocurrencies. An incremental or disruptive innovation? International Review of Sociology, 31(3), 453-469. https://doi.org/10.1080/03906701.2021.2015981

- Morosan, C., & DeFranco, A. (2016). It's about time: Revisiting UTAUT2 to examine consumers' intentions to use NFC mobile payments in hotels. International Journal of Hospitality Management, 53, 17-29. https://doi.org/10.1016/j.ijhm.2015.11.003

- Navamani, T. M. (2023). A review on cryptocurrencies security. Journal of Applied Security Research, 18(1), 49-69. https://doi.org/10.1080/19361610.2021.1933322

- Nieradka, P. (2018). Recognition of cryptocurrency based on empirical tests. Annales Universitatis Mariae Curie-Skłodowska, Sectio H Oeconomia, 52(6), 69-78.

- Nkrumah-Boadu, B., Owusu Junior, P., Adam, A., & Asafo-Adjei, E. (2022). Safe haven, hedge and diversification for African stocks: Cryptocurrencies versus gold in time-frequency perspective. Cogent Economics & Finance, 10(1), 2114171. https://doi.org/10.1080/23322039.2022.2114171

- Owusu Junior, P., Adam, A. M., & Tweneboah, G. (2020). Connectedness of cryptocurrencies and gold returns: Evidence from frequency-dependent quantile regressions. Cogent Economics & Finance, 8(1), 1804037. https://doi.org/10.1080/23322039.2020.1804037

- Piech, K. (red.). (2017). Podstawy korzystania z walut cyfrowych. Program "Od papierowej do cyfrowej Polski" Strumień Blockchain/DLT i Waluty Cyfrowe. Instytut Wiedzy i Innowacji.

- Przyłuska, J. (2016). Bitcoin - intrygująca innowacja. Bank i Kredyt, National Bank of Poland, 47(2), 137-152.

- Sierpiński, A. (2017). Bitcoin jako pieniądz - badanie funkcji ekonomicznych i społecznych kryptowaluty. Zeszyty Naukowe Politechniki Częstochowskiej. Zarządzanie, 26, 199-217. https://doi.org/10.17512/znpcz.2017.2.18

- SOCIAL.ESTATE. (n.d.). Kryptowaluta - co to jest? In Słownik terminów inwestycyjnych. Retrieved April 26, 2023, from https://social.estate/slownik/co-to-jest-kryptowaluta/

- Spyra, Ł. (2020). Rynek kryptowalut w Polsce i jego instytucjonalne uwarunkowania. Kwartalnik Nauk o Przedsiębiorstwie, 56(3), 3. https://doi.org/10.33119/KNoP.2020.56.3.5

- Sukumaran, S., Siew Bee, T., & Wasiuzzaman, S. (2023). Investment in cryptocurrencies: A study of its adoption among Malaysian investors. Journal of Decision Systems, 32(4), 732-760. https://doi.org/10.1080/12460125.2022.2123086

- Surdyk, K. (2018, March 18). Geneza pierwszej kryptowaluty - Wielka kariera kryptowaluty - część I. Kancelaria Prawna Skarbiec. https://kancelaria-skarbiec.pl/geneza-pierwszej-kryptowaluty/

- Treiblmaier, H., Leung, D., Kwok, A. O. J., & Tham, A. (2021). Cryptocurrency adoption in travel and tourism - an exploratory study of Asia Pacific travellers. Current Issues in Tourism, 24(22), 3165-3181. https://doi.org/10.1080/13683500.2020.1863928

- Uważaj na kryptowaluty. (n.d.). Informacje i ostrzeżenia. Retrieved April 26, 2023, from https://uwazajnakryptowaluty.pl/informacje-i-ostrzezenia

- Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance model: four longitudinal field studies. Management Science, 46(2), 186-204. https://doi.org/10.1287/mnsc.46.2.186.11926

- Wikarczyk, A. (2019). Rynek kryptowalut - sytuacja bieżąca i kierunki rozwoju. Studia BAS, 1(57), 143-160. https://doi.org/10.31268/StudiaBAS.2019.08

- Williams, M. D., Rana, N. P., & Dwivedi, Y. K. (2015). The unified theory of acceptance and use of technology (UTAUT): A literature review. Journal of Enterprise Information Management, 28(3), 443-488. https://doi.org/10.1108/JEIM-09-2014-0088

- Zborowski, M., & Szumski, O. (2020). Evaluation of the perception of cryptocurrencies and their online exchanges in Poland in 2019. In Management and Information Technology: New Challenges (pp. 15-28). Warsaw University of Life Sciences Press.

https://orcid.org/0000-0003-4762-127X

https://orcid.org/0000-0003-4762-127X