Informacje o artykule

DOI: https://www.doi.org/10.15219/em109.1702

W wersji drukowanej czasopisma artykuł znajduje się na s. 59–67.

Pobierz artykuł w wersji PDF

Pobierz artykuł w wersji PDF

Abstract in English

Abstract in English

Jak cytować

Gibowski, Ł. (2025). Assessment of the conditions for the development of the Financial Technology (FinTech) sector in selected countries in 2021. e-mentor, 2(109), 59–67. https://www.doi.org/10.15219/em109.1702

E-mentor nr 2 (109) / 2025

Spis treści artykułu

- Abstract

- Introduction

- The Concept of FinTech

- Research Methodology

- Research Results

- Summary

- References

Informacje o autorze

Przypisy

1 The precursor in the use of the acronym FinTech was the Vice President of the New York bank ‘Manufacturers Hanover Trust’, Bettinger, who, in the early 1970s, used it to describe the fusion of three elements: banking expertise, innovative management methods, and computers (Bettinger, 1972).

2 In this study, the two variables indicated by Folwarski (2019) were also adopted, although the number of FinTech companies was given per 500,000 inhabitants – X8. The aforementioned binary variable, on the other hand, is included as variable X12.

3 The development of quantitative taxonomy was initiated in the early 20th century by Czekanowski. However, the pioneer in applying the linear ordering method within taxonomy was Hellwig. The measure of economic development he introduced in 1968 enables the linear ranking of objects using the so-called development pattern (Hellwig, 1968; Walesiak, 2016). Taxonomic methods for constructing synthetic variables for econometric modelling processes were introduced by Bartosiewicz (1984).

4 This enables the transformation of variables to a common scale. This minimises the impact of differing units of measurement and value ranges of individual characteristics on the final value of the indicator (Młodak, 2006; Nowak, 1990).

5 The threshold value of the coefficient of variation is most commonly assumed to be ten percent (Młodak, 2006; Olszewska, 2014). When determining the critical value of Pearson’s linear correlation coefficient, reference was made to the premises adopted in other studies concerning various socio-economic phenomena in which the Hellwig method and the indicated correlation measure were applied (Kiczek, 2015; Miłek & Mistachowicz, 2019; Olszewska, 2014; Stec, 2015).

6 Its upper limit is 1. The probability that its value will be less than 0 is low (Hellwig, 1968).

7 TRM1 with header line is approx. 0.226; while S_(TMR_i ) is 0,113.

Assessment of the Conditions for the Development of the Financial Technology (FinTech) Sector in Selected Countries in 2021

Łukasz Gibowski

Abstract

The consequences of the 2007–2009 crisis, the dynamic process of digitalisation of economies, and the increased access to the Internet (especially broadband) contributed to the development of innovative technologies in the financial services sector, referred to as the financial technology (FinTech) sector. The development of the FinTech industry is not possible without active support from the state, appropriate legal regulations, innovation, and society’s readiness for new financial solutions. The aim of this article is to assess the conditions for the development of the FinTech sector in European Union countries and in major global economies. Using the taxonomic measure of economic development developed by Professor Hellwig, a ranking was constructed that shows that in 2021 the level of the analysed conditions in EU countries and in the largest global economies outside the Community was highly diverse. At the top of the ranking is the United States, which scored over eighteen times higher than the country closing the ranking (India). Poland ranked 26th (out of 34), and thus was classified as a country with conditions that are not very favourable for FinTech operation and development.

Keywords: financial services, innovation, financial technologies, taxonomic analysis, FinTech sector

Introduction

The process of integrating the financial sector with the modern technology industry, observed since the early 1970s, has contributed to the emergence of entities offering FinTech solutions. Nowadays, the efficient functioning of modern economies cannot be imagined without these entities, most commonly referred to in the subject literature as FinTech companies. The global leaders in the FinTech sector include companies such as Visa and Mastercard, which develop tools enabling cashless payments.

Along with dynamic growth, the FinTech sector has gradually expanded its activity to include new segments. FinTech companies now offer financial services in areas such as asset management, insurance, financing, and payments. Their presence in these industries significantly increases the scale of operations performed, although the scope and degree of implementation of innovative financial technologies vary between countries. This depends on many conditions, such as the nature of the regulatory and legal environment for FinTech entities, the willingness of society to use financial technologies, and the level of innovation and economic development of a given country. The development of the FinTech sector is so important for improving the quality of service in the financial market and increasing the number of transactions concluded on it that research is being conducted on the level of openness of individual economies to this sector. However, the diversity and complexity of the factors influencing its development give rise to problems in selecting a research method that enables an objective assessment of the analysed issue.

The aim of the article is to assess the conditions for the development of the FinTech sector in selected countries in 2021 using the taxonomic development measure developed by Professor Hellwig, which can be used to create country rankings. The analysis covered the 27 European Union countries as well as the United States, the United Kingdom, India, Canada, China, Japan, and Brazil. The high level of innovation in financial technologies enabled the following research hypothesis to be formulated: The best conditions for the development of the FinTech sector have been established in innovative and highly economically developed countries.

The Concept of FinTech

Financial technologies constitute a leading factor in the transformation of the financial sector on a global scale. Although the term FinTech has been known since the early 1970s1, there is still no universal definition of this term.

Currently, there are two fundamental approaches to understanding the essence of FinTech. In the first, FinTech is a form of modern digital technologies that replace, complement, or enhance existing financial services. In the second, it is a term referring to a new industry of non-traditional and innovative financial entities (Giglio, 2022; Harasim & Mitręga-Niestrój, 2018; Suryono et al., 2020). A current review of the literature on how the term FinTech is understood is presented in table 1.

Table 1Summary of the Literature Review on Defining the Term FinTech

| Approach | Authors | Interpretation of the term FinTech |

| Object-based | C. C. Vergara and L. F. Agudo | Modern technologies and digital innovations that serve to improve and automate the process of providing financial services to individuals and businesses (Vergara & Agudo, 2021). |

| L. A. Abdillah | Any information technology in the financial services industry (Abdillah, 2019). | |

| S. K. Pant | Innovative technologies used to improve the process of providing financial services (Pant, 2020). | |

| M. Anshari, M. N. Almunawar, M. Masri and M. Hamdan | Technologies used to provide financial services and products which, compared to those traditionally offered by the banking sector, are more user-friendly and convenient financial management tools for users (Anshari et al., 2019). | |

| Subject-based | Y. Kim, Y.-J.Park, J. Choi and J. Yeon | A service sector that creates and uses modern technologies focused on mobile devices to improve the efficiency of the financial sector (Kim et al., 2016). |

| W. Szpringer | Technological entities representing a specific form of shadow banking, which Szpringer (2017) defines as part of the parallel banking system offering financial intermediation services that are not subject to regulation or supervision. | |

| P. Łasak | Companies that, by combining financial services with modern technologies, contribute to the development of new business models, applications, processes, or products (Łasak, 2021). | |

| G. B. Navaretti, G. Calzolari and A. F. Pozzolo | Entities providing the same type of financial services as banks, but in a more efficient way due to the use of innovative technologies (Navaretti et al., 2017). |

Source: author’s own work based on the sources listed with each definition.

As noted by Harasim and Mitręga-Niestrój (2018), when defining the term, some FinTech researchers omit one of its most important aspects, namely, the functional aspect, which is the effects of FinTech. These include reduced costs and greater efficiency of service in the financial sector. Most researchers, however, agree on the high level of innovativeness/modernity of the FinTech phenomenon (Harasim & Mitręga-Niestrój, 2018; Schueffel, 2016).

Harasim and Mitręga-Niestrój (2018) interpret the FinTech phenomenon from both a broad and narrow perspective. According to the broad view, FinTech refers to any application of technology that improves the provision of existing financial services and/or creates new types of services. The narrow perspective, on the other hand, defines FinTech as an innovative financial services sector comprising non-traditional market participants who use modern technologies—mainly in the process of creating products and services for the banking sector. Thus there is a clear distinction between traditional and innovative financial service providers (Harasim & Mitręga-Niestrój, 2018).

For the purpose of this study, the premises derived from the narrow definition of FinTech were adopted. This approach is also used by international institutions studying the financial technology sector, such as the educational platform Centre for Finance, Technology and Entrepreneurship (CFTE).

A review of the literature reveals that the FinTech sector is commonly considered to have developed in three stages, which differ fundamentally in terms of access to financial services (Abdillah, 2019; Folwarski, 2019; Leong & Sung, 2018; Pant, 2020). A brief overview of these periods is presented in table 2.

Table 2Stages of Development of the FinTech Sector

| Period | Stage name | Description |

| 1866–1966 | FinTech 1.0 | The beginning of FinTech is marked by the establishment of the first transatlantic telegraph cable connection between Europe and North America. FinTech 1.0 was based on the development of infrastructure enabling global communication among the media, individuals, governments, organisations, and financial markets. However, it primarily concerned developed countries such as the USA, France, and the United Kingdom (Pant, 2020). |

| 1967–2008 | FinTech 2.0 | Pant (2020) identifies the activation of an ATM at a Barclays Bank branch in London as the beginning of FinTech 2.0. The years 1967–2008 marked a period of digitalisation, technological advancement, and the evolution of payment systems. In 1971, the first electronic exchange, NASDAQ, was established—an important step in the digitalisation of financial markets. The early 1980s saw developed countries’ banks shift from manual systems to computerised ones. Unlike FinTech 1.0, FinTech 2.0 extended its scope globally across various sectors. By the end of this stage, the development of internet-based business had begun (Abdillah, 2019; Leong & Sung, 2018). |

| 2009–present | FinTech 3.0/3.5 | Following the 2007–2009 financial crisis and the intensification of financialisation, a phase of rapid development in the innovative financial services sector began. Since the outset of the FinTech 3.0 era—initiated in developed countries and evolving into the FinTech 3.5 era as it expanded to developing countries—the financial technology startup industry has experienced dynamic growth. These entities, though not strictly traditional banking institutions, began offering financial and banking products and services (Folwarski, 2019; Pant, 2020). |

Source: author’s own work based on the sources cited in the descriptions of individual stages.

Today, FinTech can be assumed to be in the next stage of development, characterised by close cooperation between the financial technology sector and banks. The banking sector has become the main recipient of these solutions. This cooperation takes various forms, from alliances and mergers between entities to financial and substantive support provided to FinTech companies by banks through incubation and acceleration programmes or Venture Capital funds. Banks also establish their own FinTech companies.

The FinTech sector should be perceived as a complex and heterogeneous system composed of numerous segments and subsegments. In particular, the following segments can be identified: (1) financing; (2) asset management; and (3) payments.

Three basic subsegments make up the financing segment: those based on crowdfunding, those providing credit services, and those operating in the field of factoring (Anshari et al., 2019; Folwarski, 2019; Giglio, 2022; Kmita, 2020). Brunello (2015/2016) perceives crowdfunding as a process of cooperation among a group of individuals willing to allocate private financial resources, via specialised online platforms, in order to support the implementation of projects. The term in question, a neologism combining the words crowd and funding, is associated with projects of virtually any kind – from charitable initiatives to business ventures (Brunello, 2015/2016).

Demographic processes and changes in consumer preferences and approaches to investment strategies have contributed to the emergence of a segment within the FinTech sector that operates in the area of asset management. This gave rise to the automation of financial services, leading to phenomena such as robo-advisory and social trading (Giglio, 2022). Investors using social trading present and exchange trading ideas and investment strategies. In doing so, they observe the results achieved by other entities perceived as experts (Leong & Sung, 2018; Ziobrowska, 2021). In the subsegment related to automation, entities implement systems based on special algorithms, enabling, among other things, investment portfolio management (Kmita, 2020).

Companies forming the payments segment offer services related to the execution of domestic and international payment transactions. FinTech entities operating in this segment work using blockchain technology solutions, cryptocurrencies, and alternative payment methods (CFTE, 2022; Kmita, 2020).

With the dynamic evolution of the financial technology industry, FinTechs have gradually expanded their operations to new markets, including the insurance market. Entities operating in this field, referred to as InsurTechs, work on innovative insurance solutions. This term, similarly to FinTech, is an acronym of the words insurance and technology (Kmita, 2020).

In order to streamline the process of bringing innovative financial technologies to market, most national supervisory authorities provide various forms of support to FinTech companies. These include regulatory sandboxes and innovation hubs. The former allow companies, usually start-ups, to test their innovative financial solutions. An innovation hub, in turn, should be viewed as a dedicated contact centre, facilitating the exchange of opinions and experiences between FinTech entities (Alińska, 2019).

RegTech subsector (an acronym of regulatory technology) entities also contribute to the more efficient functioning of the FinTech sector. Using modern technologies, these entities deal with resolving contentious issues relating to regulatory and supervisory requirements. There are two types of RegTech entities: companies offering their services to supervisors, financial institutions and regulators, and entities that support only supervisors and regulators (Folwarski, 2019).

Research Methodology

As mentioned above, the development of the FinTech sector has been the subject of numerous academic studies conducted by both Polish and foreign scholars. As a result of their work, indices have been developed that measure the openness of particular economies to financial innovations. In constructing these indices, authors have employed a variety of research methodologies and sets of variables. For instance, when constructing a FinTech index for the European Union countries, Folwarski (2019) adopted six variables, including the number of FinTech companies and a binary variable indicating the existence (or non-existence) of an innovation hub2 in a given country. To determine the index value, he used decile-based classification (Folwarski, 2019).

Due to the complexity and dynamic growth of the financial technology sector, it is not possible to develop a universal indicator for assessing the conditions for the operation of the FinTech industry. In this study, a measure was selected that accounts for the multidimensional nature of FinTech and enables a hierarchy of countries to be constructed.

The proposed measure is the taxonomic measure of development created by Professor Hellwig3 (1968), which enables quantification of the level of the studied conditions by means of a single value. This measure can be used to examine economic, social, environmental, and cultural phenomena at various levels of analysis (from local to global). As a linear ordering method, it allows the ranking of objects from the highest to the lowest position in the hierarchy. This hierarchy is established based on the value of the taxonomic measure of development (TMRi). The TMRi is constructed to enable a holistic approach to the studied issue, serving as a synthetic measure of the variables that characterise it (Hellwig, 1968; Nowak, 1990).

The TMRi is structured in several stages: (1) selection of diagnostic variables and determination of their character (stimulant, destimulant or nominant); (2) analysis of the variability and mutual correlation of variables; (3) standardisation of variables4; (4) determination of the development pattern; (5) determination of Euclidean distances from the adopted development pattern for each examined unit (in this article, for each country studied); (6) calculation of the value of the TMRi (Hellwig, 1968; Nowak, 1990; Młodak, 2006).

In the study presented, fifteen diagnostic variables were initially proposed to characterise the conditions for the development of the FinTech sector in selected countries in 2021. A detailed description of the variables is presented in table 4 (Appendix). The variables were selected based on their relevance to the phenomenon studied and the quality and availability of data. In addition to substantive and formal criteria, statistical criteria related to variability and correlation of features were also taken into account. All variables used in the study were required to exhibit high variability and low mutual correlation (Kukuła, 2000; Strahl, 2006; Zeliaś, 2002). The proposed variables can essentially be classified into the following groups of factors:

- the proportion of people using selected financial services and the Internet (X1–X4, X14);

- the level of development of the services sector, including banking activity (X5–X7);

- the degree of economic development and innovation of countries (X9–X11) – as innovative and economically developed countries provide favourable conditions for the creation of new technologies;

- the state of the regulatory and legal environment for the FinTech sector (X12);

- the development of FinTech companies (X8 and X13);

- the level of cybersecurity (X15) – this is a particularly important aspect in the context of risks related to data theft from institutions using financial technologies.

From the initially proposed set of variables, those with low variability (i.e., variables for which the coefficient of variation was below ten percent) and those showing a strong correlation (i.e., for which the absolute value of Pearson’s correlation coefficient exceeded 0.7)5, were eliminated. Ultimately, four features were rejected (X1, X2, X5, and X10).

In order to standardise the heterogeneous data into comparable values, the features were normalised by standardisation according to formula 1 (Hellwig, 1968; Młodak, 2006; Nowak, 1990):

where:

- Zik – standardised value of feature k in unit i;

- xik – absolute value of feature k in unit i;

- ̄xk – arithmetic mean of feature k;

- Sk – standard deviation of feature k;

- n – number of countries;

- m – number of variables.

As a result, a matrix of standardised variable values Z was obtained:

Based on the […], a development pattern was determined, representing an abstract object (country) P₀ with the most favourable values of the diagnostic variables describing the studied phenomenon (Hellwig, 1968):

where:

- z0k = max{zik} for stimulants,

- z0k = min{zik} for destimulants.

In the next step, for each of the studied entities (countries), the Euclidean distances (di0) from the development pattern were calculated using formula (4) (Hellwig, 1968; Nowak, 1990):

Ultimately, the taxonomic development measure TMRi was determined using formula (5) (Hellwig, 1968):

where:

The TMRi usually takes values in the range [0, 1]6 (Hellwig, 1968). The closer its value is to 1, the closer a given country is to the pattern and the more favourable are its conditions for the development of the FinTech sector. Additionally, using the arithmetic mean value ( ) and the standard deviation (STMRi) of the TMRi, each country was assigned to one of the following groups (Stec, 2015; Zeliaś, 2002):

) and the standard deviation (STMRi) of the TMRi, each country was assigned to one of the following groups (Stec, 2015; Zeliaś, 2002):

- I – countries with very favourable conditions for the development of the FinTech sector (TMRi ≥

+ STMRi)7;

+ STMRi)7; - II – countries with highly favourable conditions for the development of the FinTech sector (

≤ TMRi <

≤ TMRi <  + STMRi);

+ STMRi); - III – countries with somewhat favourable conditions for the development of the FinTech sector (

– STMRi ≤ TMRi <

– STMRi ≤ TMRi <  )

) - IV – countries with the least favourable conditions for the development of the FinTech sector (TMRi <

– STMRi).

– STMRi).

The value of the taxonomic development measure was determined for 34 countries. These included all European Union Member States and other major world economies. This selection was based on several important premises. Firstly, the selected countries have stable financial systems and play a key role in the international financial sector. Secondly, their diversity in terms of economic, social, and regulatory-legal conditions enables examination of the factors determining the development of favourable conditions for the FinTech sector. Additionally, the availability of high-quality statistical data for the selected countries facilitates the conduct of research related to the FinTech sector.

Research Results

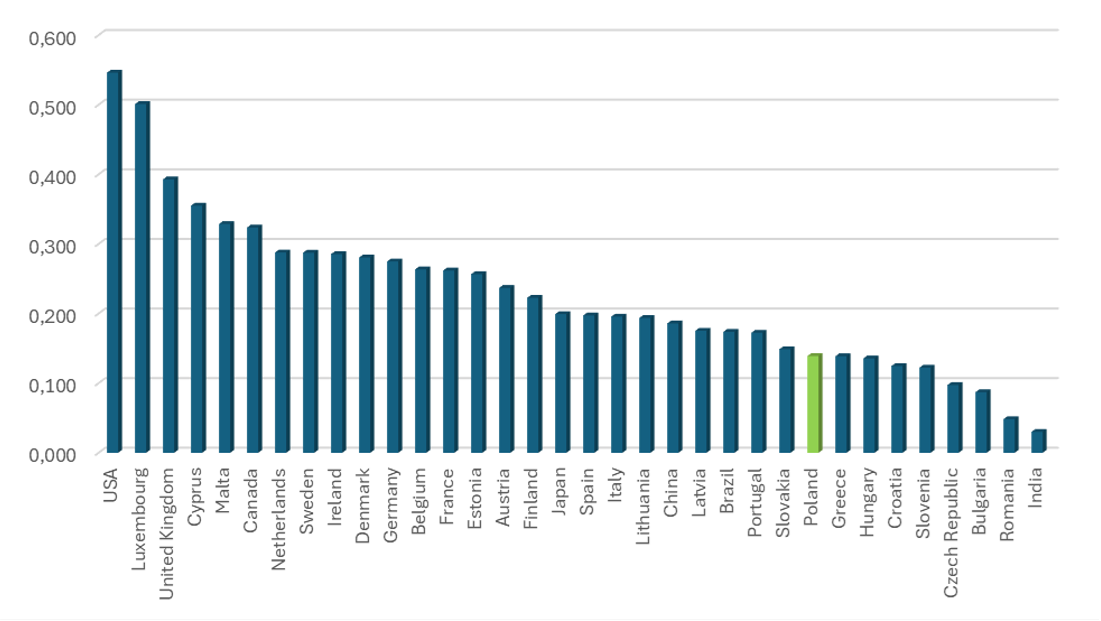

The results of the conducted analysis are presented in table 3 and illustrated in figure 1. The calculations were performed using Microsoft Excel.

Table 3Classification of the Examined Countries According to the Constructed Measure of FinTech Sector Development Conditions

| Group | Ranking | Country | TMRi value |

| Group I (TMRi ≥ 0.338) | 1 | USA | 0.546 |

| 2 | Luxembourg | 0.501 | |

| 3 | United Kingdom | 0.393 | |

| 4 | Cyprus | 0.355 | |

| Group II (0.226 ≤ TMRi < 0.338) | 5 | Malta | 0.329 |

| 6 | Canada | 0.324 | |

| 7 | Netherlands | 0.288 | |

| 8 | Sweden | 0.287 | |

| 9 | Ireland | 0.285 | |

| 10 | Denmark | 0.281 | |

| 11 | Germany | 0.275 | |

| 12 | Belgium | 0.263 | |

| 13 | France | 0.262 | |

| 14 | Estonia | 0.257 | |

| 15 | Austria | 0.237 | |

| Group III (0.113 ≤ TMRi < 0.226) | 16 | Finland | 0.223 |

| 17 | Japan | 0.199 | |

| 18 | Spain | 0.197 | |

| 19 | Italy | 0.196 | |

| 20 | Lithuania | 0.194 | |

| 21 | China | 0.186 | |

| 22 | Latvia | 0.175 | |

| 23 | Brazil | 0.174 | |

| 24 | Portugal | 0.172 | |

| 25 | Slovakia | 0.149 | |

| 26 | Poland | 0.1389 | |

| 27 | Greece | 0.1386 | |

| 28 | Hungary | 0.136 | |

| 29 | Croatia | 0.125 | |

| 30 | Slovenia | 0.122 | |

| Group IV (TMRi < 0.113) | 31 | Czech Republic | 0.097 |

| 32 | Bulgaria | 0.087 | |

| 33 | Romania | 0.048 | |

| 34 | India | 0.030 |

Source: author’s own work.

Figure 1

TMRi Index Values for Selected Countries in 2021

Source: author’s own work.

The study results showed that in 2021 the United States was the most favourable country for the operation and further development of the FinTech sector (0.546 points). The next positions in the ranking were taken by Luxembourg, the United Kingdom, and Cyprus. The high ranking of these leaders was determined, among other things, by the high percentage of people holding an account with a financial institution or a mobile financial services provider. This indicates a strong inclination of residents of these countries to use financial services, which generates demand for FinTech solutions. Countries in Group I also had the highest share of exports of financial and insurance services in total commercial service exports. In each of these countries, FinTech companies had broad access to tools facilitating compliance with regulatory and legal obligations for their operations. Furthermore, the United States and the United Kingdom were awarded very high values in innovation and cybersecurity indices. This means that they provided friendly and secure conditions for the development of innovative financial technologies. In Luxembourg and Cyprus, alongside Estonia and Malta, the highest number of FinTech companies per 500,000 inhabitants was recorded in 2021. However, the United States and the United Kingdom hosted the highest number of major FinTech players globally, with 46 and 7 companies respectively, according to the CFTE.

Among the least FinTech-friendly countries in 2021 were, from the lowest position: India, Romania, Bulgaria, and the Czech Republic, with India’s TMRi score being 0.067 points lower than that of the Czech Republic. India’s poor result was driven in part by the highest percentage of people with inactive bank accounts and the lowest value added in the services sector (as a percentage of GDP) among all the surveyed countries. In 2021, India also had a significantly lower GDP per capita compared to the remaining countries. Moreover, India and Romania were among the least innovative economies. In India, Romania, and Bulgaria, the lowest percentage of people with an account at a financial institution or mobile provider was recorded, which may indicate a low willingness of citizens to use financial services and/or barriers in access to them. Notably, despite these unfavourable conditions, several global FinTech companies have emerged in India (e.g. the financial platform Razorpay).

Poland, with a TMRi score of 0.139 points, ranked 26th in the table, placing it among fourteen other countries where the conditions for FinTech sector development were classified as unfavourable. In Poland, the number of FinTech companies per 500,000 inhabitants was relatively low (tenth from the bottom). Moreover, none of the FinTech companies was included in the list of the top one hundred FinTech companies globally. The development of the FinTech sector in Poland was also hindered by the relatively low level of economic development and innovativeness (seventh place from the bottom for development and sixth place from the bottom for innovativeness).

Summary

The development of financial technologies is introducing a new quality in the provision of financial services. The phenomenon under study has spread across the global financial system, yet the level of FinTech sector development varies significantly between countries. This variation is due to numerous factors. The taxonomic measure of development (TMRi) constructed in this study, which takes into account various aspects that promote or hinder the development of financial technologies, made it possible to identify, evaluate, and classify the countries analysed in terms of the level of development of the relevant conditions.

The results of the study confirm the research hypothesis. As demonstrated, the level of development of the conditions under analysis varied significantly among EU Member States and the largest non-EU world economies. The gap between the countries with the highest and the lowest TMRi scores was 0.516 points. The United States was the most favourable country for the FinTech sector in 2021, while India was the least favourable. The United States is an innovative and economically developed country with a strong capacity for cybersecurity. In contrast, the main barriers to the development of this sector in India were a low percentage of people holding bank accounts, low GDP per capita, and low level of innovativeness. Poland was ranked among the countries with less favourable conditions for the FinTech sector. Among the EU countries, Poland was only ahead of Greece, Hungary, Croatia, Slovenia, the Czech Republic, Bulgaria, and Romania.

The study results indicate that countries classified in Groups III and IV require an in-depth analysis of the current state of the financial technology sector. This analysis should serve to devise an effective strategy for measures to support the development of the FinTech sector. Estonia may be considered a model for effectively creating favourable conditions for the sector’s development. Despite having a much lower level of economic development than countries such as Germany, Sweden, Denmark, and France, Estonia ranked among the countries with highly favourable conditions for the development of the FinTech sector. This is because Estonia follows a pro-innovation approach to developing modern technologies. The Estonian government has created simple and transparent legal regulations, thereby facilitating the establishment and operation of businesses in the financial technology sector. In addition, the development of the FinTech sector in Estonia is supported by a high level of digitalisation of society and the widespread use of mobile and internet technologies among its population.

The future development of the FinTech sector in individual countries will be shaped by numerous factors, including the intensity of work undertaken by national regulators in developing solutions for companies creating financial innovations. The state of the industry in question will also be significantly influenced by the level of public trust in newly developed financial technologies, as well as the effectiveness of institutions responsible for ensuring safe conditions in cyberspace. During the course of the study, however, a research gap was identified in terms of precisely determining the impact of FinTech sector development on the security of the financial sector. It would seem appropriate to conduct a study that takes into account the perspectives of both financial institutions and individuals using financial services.

References

- Abdillah, L. A. (2019). An overview of Indonesian Fintech application. In Proceeding: International Conference on Communication, Information Technology and Youth Study (I-CITYS 2019) (pp. 8–16). https://ssrn.com/abstract=3512737

- Alińska, A. (2019). Alternatywne finanse [Alternative finance]. CeDeWu.

- Anshari, M., Almunawar, M. N., Masri, M., & Hamdan, M. (2019). Digital marketplace and FinTech to support agriculture sustainability. Energy Procedia, 156, 234–238. https://doi.org/10.1016/j.egypro.2018.11.134

- Bartosiewicz, S. (1984). Zmienne syntetyczne w modelowaniu ekonometrycznym [Synthetic variables in econometric modeling]. Prace Naukowe Akademii Ekonomicznej im. Oskara Langego we Wrocławiu, 262, 5–8.

- Bettinger, A. (1972). FinTech: A series of 40 time shared models used at Manufacturers Hanover Trust Company. Interfaces, 2(4), 62–63. https://www.jstor.org/stable/i25058917

- Brunello, A. (2015/2016). Crowdfunding. Podręcznik. Jak realizować swe pomysły za pomocą nowych narzędzi finansowania online [Crowdfunding. The Handbook. How to implement your ideas with new online funding tools]. CeDeWu.

- CFTE. (2022). Top Fintech Unicorns 2021 Review. https://courses.cfte.education/wp-content/uploads/2022/01/Top-Fintech-Unicorns-in-2022.pdf

- Folwarski, M. (2019). Sektor FinTech na europejskim rynku usług bankowych. Wyzwania konkurencyjne i regulacyjne [FinTech sector in the european banking services market. Competitive and regulatory challenges]. Poltext.

- Giglio, F. (2022). Fintech: A literature review. International Business Research, 15(1), 80–85. https://doi.org/10.5539/ibr.v15n1p80

- Harasim, J., & Mitręga-Niestrój, K. (2018). FinTech – dylematy definicyjne i determinanty rozwoju [FinTech – definitional dilemmas and drivers of growth]. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, 531, 169–179. http://dx.doi.org/10.15611/pn.2018.531.15

- Hellwig, Z. (1968). Zastosowanie metody taksonomicznej do typologicznego podziału krajów ze względu na poziom ich rozwoju oraz zasoby i strukturę wykwalifikowanych kadr [Procedure of evaluating high level manpower data and typology of countries by means of the taxonomic method]. Przegląd Statystyczny, 15(4), 307–327.

- ITU. (2021). Global Cybersecurity Index. https://www.itu.int/pub/D-STR-GCI.01

- Kiczek, M. (2015). Ocena rozwoju gmin województwa podkarpackiego (z wykorzystaniem metody Hellwiga) [Development level rating of podkarpackie province communes (with Hellwig Metod)]. Modern Management Review, 22(3), 87–100. http://dx.doi.org/10.7862/rz.2015.mmr.37

- Kim, Y., Park, Y.-J., Choi, J., & Yeon, J. (2016). The adoption of mobile payment services for “Fintech”. International Journal of Applied Engineering Research, 11(2), 1058–1061.

- Kmita, A. (2020). FinTech na rynku polskim [FinTech on the Polish market]. Zeszyty Studenckie Wydziału Ekonomicznego ,,Nasze Studia”, 10, 56–65.

- Kukuła, K. (2000). Metoda unitaryzacji zerowanej [Zero unitarization method]. PWN.

- Leong, K., & Sung, A. (2018). FinTech (Financial Technology): What is it and how to use technologies to create business value in Fintech way? International Journal of Innovation, Management and Technology, 9(2), 74–78. http://dx.doi.org/10.18178/ijimt.2018.9.2.791

- Łasak, P. (2021). Formy współpracy banków i podmiotów FinTech – w kierunku większej cyfryzacji polskiego sektora bankowego [Form of cooperation between banks and FinTechs: towards geater digitalization of the polish banking sektor]. In M. Kaleta, M. Laska, & D. Żuchowska (Eds.), Współczesne uwarunkowania i dylematy polityki gospodarczej (pp. 38–52). Wyższa Szkoła Kultury Społecznej i Medialnej w Toruniu.https://www.wydawnictwo.aksim.edu.pl/wp-content/uploads/2021/12/e-book_polityka-gospodarcza_gotowe.pdf

- Miłek, D., & Mistachowicz, M. (2019). Ocena innowacyjności polskiej gospodarki na tle krajów Unii Europejskiej [Assessment of the innovativeness of the Polish economy in comparison to the European Union countries]. Nierówności Społeczne a Wzrost Gospodarczy, 59(3), 61–82. https://doi.org/10.15584/nsawg.2019.3.4

- Młodak, A. (2006). Analiza taksonomiczna w statystyce regionalnej [Taxonomic analysis in regional statistics]. Difin.

- Navaretti, G. B., Calzolari, G., Mansilla-Fernández, J . M., & Pozzolo, A. F. (2017). FinTech and Banks: Friends or Foes? European Economy – Banks, Regulation, and the Real Sector, 9–30. https://european-economy.eu/wp-content/uploads/2018/01/EE_2.2017-2.pdf

- Nowak, E. (1990). Metody taksonomiczne w klasyfikacji obiektów społeczno-gospodarczych [Taxonomic methods for classification of social and economic objects]. PWE.

- Olszewska, A. M. (2014). Wykorzystanie wybranych metod taksonomicznych do oceny potencjału innowacyjnego województw [The application of selected quantitative methods to the evaluation of voivodeship innovation level potential]. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, 328, 167–176.

- Pant, S. K. (2020). Fintech: Emerging trends. Telecom Business Review, 13(1), 47–52. https://ssrn.com/abstract=3763946

- Polski Fundusz Rozwoju. (2021). Ranking Bloomberg Innovation Index – które kraje są najbardziej innowacyjne? [Bloomberg Innovation Index Ranking – which countries are the most innovative?]. https://startup.pfr.pl/artykul/ranking-bloomberg-innovation-index-ktore-kraje-sa-najbardziej-innowacyjne

- Schueffel, P. (2016). Taming the beast: A scientific definition of Fintech. Journal of Innovation Management, 4(4), 32–54. https://doi.org/10.24840/2183-0606_004.004_0004

- Stec, A. (2015). Zastosowanie metody Hellwiga do określenia atrakcyjności turystycznej gmin na przykładzie województwa podkarpackiego [Application of Hellwig method to determine the tourist attractiveness of municipalities - podkarpackie voivodeship example]. Metody Ilościowe w Badaniach Ekonomicznych, 16(4), 117–126. https://bazekon.uek.krakow.pl/rekord/171415203

- Strahl, D. (2006). Metody oceny rozwoju regionalnego [Methods for assessing regional development]. Wydawnictwo Akademii Ekonomicznej im. O. Langego we Wrocławiu.

- Suryono, R. R., Budi, I., & Purwandari, B. (2020). Challenges and trends of Financial Technology (Fintech): A systematic literature review. Information, 11(12), 590. https://doi.org/10.3390/info11120590

- Szpringer, W. (2017). Nowe technologie a sektor finansowy. FinTech jako szansa i zagrożenie [New technologies and the financial sector. FinTech as an opportunity and a threat]. Poltext.

- Walesiak, M. (2016). Wizualizacja wyników porządkowania liniowego dla danych metrycznych z wykorzystaniem skalowania wielowymiarowego [Visualization of linear ordering results for metric data with the application of multidimensional scaling]. Ekonometria, 2(52), 9–21. https://doi.org/10.15611/ekt.2016.2.01

- World Intellectual Property Organization. (2021). Global Innovation Index 2021 (14th Edition). https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2021.pdf

- Vergara, C. C., & Agudo, L. F. (2021). Fintech and sustainability: Do they affect each other? Sustainability, 13(13), 1–19. https://doi.org/10.3390/su13137012

- Zeliaś, A. (Ed.). (2002). Taksonomiczna analiza przestrzennego zróżnicowania poziomu życia w Polsce w ujęciu dynamicznym [Taxonomic analysis for spatial differentiation of Polish standard of living, with a dynamic approach].Wydawnictwo Akademii Ekonomicznej w Krakowie.

- Ziobrowska, J. (2021). Handel społecznościowy jako alternatywna forma inwestowania dla nieprofesjonalnych inwestorów [Social trading as an alternative form of investing for non-professional investors]. Internetowy Kwartalnik Antymonopolowy i Regulacyjny, 10(6), 38–48.

https://orcid.org/0009-0007-9661-8268

https://orcid.org/0009-0007-9661-8268