About the article

DOI: https://www.doi.org/10.15219/em109.1708

The article is in the printed version on pages 45–58.

Download the article in PDF version

Download the article in PDF version

How to cite

Alexeeva-Alexeev, I., Kaminska, A., Mazas-Perez, C., Anton, S.G. (2025). More than socio- and geo-demographics: How complementary education and business experience shape students’ financial behaviour in Europe. e-mentor, 2(109), 45–58. https://www.doi.org/10.15219/em109.1708

E-mentor number 2 (109) / 2025

Table of contents

About the authors

More than Socio- and Geo-demographics: How Complementary Education and Business Experience Shape Students' Financial Behaviour in Europe

Inna Alexeeva-Alexeev, Ana Kaminska, Cristina Mazas-Pérez, Sorin Gabriel Anton

Abstract

Although financial literacy would seem relevant to university students’ education, it is not currently offered as a transversal subject within European academic curricula. It should therefore come as no surprise that a common solution are ad-hoc specific courses, with students often additionally acquiring valuable learning through their own experiences in business environments. With this and the recent literature on the drivers of financial literacy in mind, the authors decided to explore the context shaped by socio-demographic, academic and work-related factors that either promote or prevent European university students from developing appropriate financial skills, such as managing personal finances, planning for short- and long-term needs, and distinguishing among different sources of non-traditional funding. The study used a sample of 881 undergraduate and postgraduate university students from Romania, Poland and Spain from different studies, with information obtained through an anonymous online survey. The applied econometric model was cumulative regression with location-scale estimation using the R software, version 4.3.2, with variables associated directly with the development of basic financial skills being age, gender, country, but also specific training as well as work and entrepreneurial experience. The authors stress the importance of providing financial management education connected to the reality, especially the business and entrepreneurial environment.

Keywords: university students, entrepreneurial experience, non-traditional funding, personal finance management,+ cumulative regression

Introduction

Several studies worldwide show that proper financial behaviour, understood as behaviour related to money management (Xiao, 2016), is directly influenced by proper financial education and literacy (Bruhn et al., 2016; Kaiser & Menkhoff, 2020; Wagner & Walstad, 2018). This question is especially relevant for university students for three main reasons. Firstly, financial education as such is not included as a defined block of studies in any official undergraduate or postgraduate university degree in the European Union. Secondly, university students are becoming increasingly economically and financially independent, which involves the need to deal with financial questions. According to the definition proposed by the OECD (2024, p. 6), the term "financial literacy" means “a combination of financial awareness, knowledge, skills, attitudes and behaviours necessary to make sound financial decisions and ultimately achieve individual financial well-being”. Thirdly, the higher education environment is meant to foster the entrepreneurial spirit of university students (Valencia-Arias et al., 2022), greatly influencing the development of entrepreneurial skills (Ferreras-Garcia et al., 2021). Therefore, the support provided to them should also include financial education and guidance adapted to entrepreneurship.

The majority of studies attempt to identify the level of financial knowledge of university students, assessed from a theoretical perspective by applying specific tests to measure the financial literacy of young adults. However, little attention is paid to analysing the financial attitudes and financial behaviour of this group, which is not always evident and requires a different approach in order to measure them properly. Potrich et al. (2016) explain that financial attitudes play an important role, influencing decision-making in terms of finances, while Yahaya et al. (2019) go even further, pointing out that it is financial attitudes and not so much financial knowledge that have a significant impact on students’ financial behaviour.

The latter concept is extremely important as it refers to an action that can be interpreted as appropriate behaviour of a person in terms of managing personal finances (Ingale & Paluri, 2022; Potrich et al., 2016) and implies individual responsibility by using different economic and financial resources to meet certain (personal) goals (Sugiyanto et al., 2019). Financial management is reflected in knowing how to plan, budget, control and search for financial funds to cover personal needs (Herdjiono et al., 2018). In this regard, this question is considered critical for university students as young adults and potential labour market players, recognising financial literacy as one of the core elements to be thoroughly analysed in order to obtain a clearer picture of what should be amended in the current proposals and practice of financial education.

Based on the literature review, an empirical study is pertinent to analyse financial literacy through the perception of certain basic financial skills among students of Spanish, Polish and Romanian universities, with the skills under analysis being those related to management (managing personal finances), planning (planning short- and long-term financial needs), and understanding new forms of financing as an alternative way to finance entrepreneurial initiatives (distinguishing among non-traditional sources of finance). The main objective is to determine the likelihood at which different factors, such as socio-demographic characteristics as well as academic and employment background, are related to these skills. We hypothesise that age, gender and specific training in finance significantly influence the personal financial management skills of European university students, and further anticipate a notable impact from their work and entrepreneurial experience. These expected results are regardless of the country of study, as in most of them the level of financial literacy is quite low.

This study is part of the project titled “Digital Simulator for Entrepreneurial Finance” (FINANCEn_LAB), reference number: 2020-1-ES01-KA226-HE-095810, funded through Erasmus+, Call 2020 Round 1 KA2 - Cooperation for innovation and the exchange of good practices, KA226 - Partnerships for Digital Education Readiness.

The structure of this work is as follows: first, a literature review is offered through which the authors provide evidence on the importance of different factors related to the objective of the study; second, the applied methodology together with the econometric models is explained, along with a description of the sample and the variables; third, the findings are presented; and fourth, the discussion and conclusions are outlined.

Literature Review

The OECD study was one of the first to highlight the importance of financial literacy, included in the OECD PISA assessment of 15-year-old students since 2012 (OECD, 2014), and the need to develop financial education policies and programmes in the early 21st century. With the importance of financial literacy becoming widespread, the developed methodology for the assessment of financial literacy started to be a kind of universal template for further studies. Following this initiative, many research studies, led by international organisations as well as academic researchers, focus on different questions ranging from assessing financial knowledge to measuring the effectiveness of learning methods, or the impact of financial knowledge on individuals' behaviour, well-being and, finally, on the macroeconomy of the country (Fornero & Prete, 2023; Lusardi & Messy, 2023).

The focus on the younger population, such as university students, can be seen not only in institutional reports but also in the academic literature. Most studies are related to measuring the level of financial literacy for which special test toolkits are used (Dahiya et al., 2023; Katenova & Lee, 2018; Pavković et al., 2018), while research findings, in their majority, are carried out with a sample of a particular country, with only a few including more than one country (Ergün, 2018; Polák, 2020). Existing research extends beyond the measurement of financial knowledge, analysing its relations with financial behaviour and attitudes (Chmelíková, 2015; Ingale & Paluri, 2022; Mireku et al., 2023; Owusu et al., 2023).

Academic research analyses certain demographic characteristics, such as gender or age and their relationship with university students' financial behaviour (Ergün, 2018; Khalisharani et al., 2022; Susanti & Hardini, 2018), with age generally related to life experience, which translates into enhanced financial knowledge in years and experience (Mitchell & Lusardi, 2022), with older university students tending to be more skilful in managing personal finances (del Rosario Arambulo-Dolorier et al., 2024; Lusardi, 2019). The following hypothesis is therefore proposed:

H1: Older university students are more likely to be highly skilled in managing personal finance.

With gender in mind, it should be noted that the results are contradictory in the case of female participants, with most studies aimed at gender relations and financial behaviour pointing out that in general, women have lower financial literacy, resulting in their decision-making being different (Garg & Singh, 2018; García Mata, 2021; Wee & Goy, 2022). On the other hand, other studies focused on the segment of university students do not provide evidence that gender plays a critical role in assessing the financial knowledge and decision-making of female students (Demirgüç-Kunt, 2021; Susanti & Hardini, 2018). Moreover, recent studies show that women are more likely than men to set financial goals and create financial security plans (Liu, 2021), and tend to exhibit better financial attitudes and behaviours, despite potentially having less financial knowledge (Gudjonsson et al., 2022). The following is proposed accordingly:

H2: The likelihood of managing personal finance successfully is higher among female university students.

Reports published by the OECD (2017; 2020) repeatedly show students’ lack of basic financial knowledge, demonstrating that they struggle to apply successfully financial concepts to real-life situations. Surprisingly, a lack of financial understanding characterises both countries with weak as well as developed economies (G7 and G20). The differences found generally refer to other aspects, such as immigrant background, gender, etc., with most countries showing a rather low level of financial literacy among young people, including university students (Lusardi & Messy, 2023). The following hypothesis is therefore formulated:

H3: The relationship between the country where university students study and their skills in managing personal finance is not significant.

According to the definition of financial literacy proposed by the OECD (2024), it is not only financial awareness but also experience that matters. Supposedly, the more practical experience with financial matters the greater the knowledge (Ergün, 2021), meaning that theoretical knowledge is important, but insufficient. The importance of actual experience in the business world via employment contracts or entrepreneurship should be stressed in this case. Previous financial experience, generally acquired through work experience, is much more beneficial than specific courses when it comes to proper financial decision-making (Chabaefe & Qutieshat, 2024), contributing to healthier financial behaviour of young people (Nano & Mema, 2017). This idea is also supported by other studies (see Ahmaddien et al., 2019; Andreeva et al., 2020; Johan et al., 2021). Thus, the following hypotheses are proposed:

H4: Specific financial literacy training increases the likelihood that university students will successfully manage their personal finances.

H5: University students' work experience increases the likelihood of managing their personal finances successfully.

It is also relevant to consider that financial behaviour is formed through consumption, entrepreneurship and finance management (Narmaditya & Sahid, 2023), although there is limited research examining how prior entrepreneurial experience enhances the financial behaviour or skills of young adults, with only a few studies indirectly suggesting that this might be so if one interprets ‘prior financial responsibility’ (Harrington et al., 2016) or ‘financial management training’ (Kirsten, 2018) as part of entrepreneurial experience, which is somewhat subjective. When someone starts their own business with prior experience in various projects, they naturally acquire a certain level of financial knowledge during the process, which is crucial and positively influences the entrepreneur’s financial attitude, leading to more rational financial decision-making (Okičić, 2019). The following is therefore formulated:

H6: University students with an entrepreneurial background are more likely to manage personal finance successfully.

It is important to note that effective personal financial management, including both short- and long-term financial planning, involves, among others, the ability to identify necessary financial funds - not only traditional ones but also increasingly prevalent alternative forms of financing (Bonini et al., 2019). This is especially true when it comes to emerging business proposals or personal projects (studies, sports, culture) that require strong financial backing but experience difficulties in accessing traditional funding (Cho & Lee, 2018; Huth & Kurscheidt, 2022). Alternative financing, most suitable for entrepreneurs, refers to venture capital, any form of private equity, or loans (peer-to-peer lending) to which business angels or crowdfunding are related (Cumming & Johan, 2017). In several US states, schools have introduced specific training, with alternative financing as part of personal financial management (Harvey, 2019). Aware of the lack of knowledge of university students of alternative financing and encouraging entrepreneurship among young people, Audretsch (2017) suggests that they should have contact with real investors to improve this gap.

Methodology

The study used an anonymous online survey conducted at universities in Spain, Romania and Poland, with adult university students duly informed about the research purpose, providing consent to participate by answering the questions. The educational institutions were not therefore required to undergo the specific procedure for obtaining authorisation from the respective Ethics Committees, nor did this entail any responsibility under the Organic Law on Data Protection, Data Custody, and ARCO rights.

The questionnaire includes different blocs of questions that help to describe the sample and identify the relationship among different variables. For this study, the focus is placed on questions that provide categorical variables, treated in the analysis as independent, and ordinal variables, treated as dependent. The first bloc of questions refers to the following variables: gender; age; country of study at the moment of the survey; academic level distinguishing between under- and postgraduates; additional specific studies, typically short-term courses in entrepreneurship (delivered in traditional and digital format) and in financing; work or internship experience; and entrepreneurial experience. All these questions collect responses on a nominal scale, except for age, which is on a ratio scale. The second bloc of the questionnaire includes a large number of different statements related to different skills relevant to financial literacy. All the statements implied answers using a seven-point Likert scale, with 1 as “totally disagree” and 7 as “totally agree”. The questionnaire used for this study is offered in Appendix 1.

Given the space limitations of this paper and the extensive output generated by applying econometric models to each variable, only four dependent variables were selected for this research, corresponding to basic financial skills and contributing to successful financial management: (a) ability to manage personal finances; (b) confidence in planning effectively for future financial needs in the short term; (c) confidence in planning effectively for future financial needs in the long term; (d) ability to differentiate among different non-traditional financing sources. These manifestations are at the root of financial behaviour, as analysed by different researchers (Andarsari & Ningtyas, 2019; Huang, 2016; Khalisharani et al., 2022), so it therefore seems appropriate to start analysing what shapes university students’ financial behaviour to offer effective measures that would lead to the right financial attitude and decision-making to help achieve greater financial stability.

The sample includes 881 university students from Poland, Romania and Spain, mainly between the ages of 18 and 23, studying at different undergraduate and postgraduate (Master's and PhD) levels. The selection of countries is in line with the project framework, in which universities from Poland, Romania and Spain participated. Nearly 13% of respondents study in Spain, about one-third in Poland, and 57% in Romania. The majority of respondents are female (68%), about a third are male (30%), and a minority (1.7%) of students do not identify themselves with any of the binary genders or prefer not to answer. The vast majority of participants are undergraduates (95%), of which seven out of ten study Economics and Business Administration. Approximately 8% of the undergraduates study Law and Political Science or Engineering, which also includes Exact Sciences. A smaller percentage, around 3%, are in Education, Humanities and Social Sciences, while the rest of the participants declared to have been studying Master or Ph.D. programmes, mainly focused on Economics and Business Administration.

Regarding the students’ previous background as additional specific training and work experience, only one-third part of the sample had taken additional courses, either in traditional or digital format. In the case of longer specific studies, this percentage is lower by 6 points. Approximately half of the participants claim work experience through an employment contract or internship. Finally, approximately 10% of the participants are entrepreneurs, quite balanced between experienced entrepreneurs with at least one business created and entrepreneurs who were creating their company at the moment of the survey. All this information is presented in Table 1.

Table 1Descriptive Statistics of the Sample, in % of the Total

| Socio-demographics | |||||||

| Gender | % | Age | % | Country of studies | % | Academic level | % |

| Female | 68.3 | 18-22 | 68.8 | Poland | 29.6 | Undergraduate | 95.1 |

| Male | 30.0 | 23-30 | 22.1 | Romania | 57.7 | Postgraduate | 4.9 |

| Other | 1.7 | 31-40 | 6.0 | Spain | 12.7 | ||

| >41 | 3.1 | ||||||

| Total | 100 | 100 | 100 | 100 | |||

| Educational background | |||||||

| Formal studies | % | Traditional courses | % | ||||

| Economics | 72.9 | Yes | 14.8 | ||||

| Engineering | 8.4 | No | 85.2 | ||||

| Law and Politics | 7.3 | Digital courses | % | ||||

| Humanities | 3.4 | Yes | 17.3 | ||||

| Education | 3.1 | No | 82.7 | ||||

| Social Sciences | 3.1 | Specific studies | % | ||||

| Exact Studies | 1.1 | Yes | 26.2 | ||||

| Health | 0.6 | No | 73.8 | ||||

| Audiovisual Communication | 0.2 | ||||||

| Total | 100 | 100 | |||||

Source: authors' own work.

Given the nature of the dependent variables, which assess various financial skills on an ordinal scale, a cumulative ordinal logistic model is employed. Within the taxonomy of ordinal regression models, cumulative models are based on the assumption that there is an underlying latent regression with a continuous dependent variable (McCullagh, 1980; Tutz, 2022) defined by the following equation (1):

Where Yi is the i-th observation of the dependent variable; xiT is the transpose vector of observations of the explanatory variables for the i-th individual; β is the vector of associated parameters relating each explanatory variable to the dependent variable, and ϵi is the error term with a continuous distribution. Scale-ordinal observations can be represented given a random variable that takes a value if the i-th observation of the dependent variable belongs to the k-th category, where k = 1,…,7. The general cumulative model, corresponding to the underlying model in equation (1), can be expressed as follows (equation (2)):

Where Yi is the value of the dependent variable for the i-th individual and β0k are the thresholds, also called intercepts, for the k-th level that should be ordered. xiT and β are defined as in equation (1), and the link function (F) used is the logistic function. Regarding the collected data, it is worth noting that they proceed from the answers of the participants with different characteristics and backgrounds, with one of the main problems encountered in the estimation of model (2) being the potential heterogeneity in the population, which can lead to inconsistent results (Tutz, 2022). To reflect this reality and optimise the model, the estimation of a location-scale cumulative ordered model is proposed as an alternative to nominal effects, which collect different thresholds dependent on other regressors when the data contains non-proportional probability structures. These are considered more robust, since the model is accurately defined for all values of the explanatory variables, regardless of the translocation and scaling of the covariates.

Additionally, a scale test is applied to identify the variables that can create significant heterogeneity within the model, helping to determine whether the relationship between the independent and dependent variables is the same for all categories. To perform the scale test, two nested models are compared: a full model that includes all the independent variables and a restricted model that excludes one or more of the independent variables, with the test statistics for the scale test based on the difference in log-likelihoods between the full and the restricted models. Finally, the cumulative ordinal location-scale model can be rewritten using equation (2), which delivers equation (3):

The variables that generate heterogeneity are collected in the transposed vector ziT for the i-th observation, and α is the vector of parameters associated with these variables. After estimating the models, an ANOVA/log-likelihood test is applied to check the robustness of the estimation made with the models defined in equation (3), which helps to detect whether the cumulative location-scale model improves the explanatory capacity of the dependent variable, comparing models (2) and (3).

Considering the methodology described and the nature of the dependent and independent variables, four models were estimated to determine the effectiveness of geodemographic characteristics of the participants, as well as the factors related to education and business experience on the perceived level of financial literacy of university students. These models correspond to equation (4):

(Yil ≤ k)=F(β0k + β1Agei + β2Genderi + β3Studiesi + β4Ac.Leveli + β5Countryi + β6Traditionali + β7Digitali + β8Intenshipi + β9Work Experiencei + β10Business establishedi + β11Setting up Business nowi + β12Specific_studiesi); i = 1,…,n; l = 1,…,4; k = 1,…,7; (4)

All the four estimated models, each corresponding to one of the proposed financial skills, use a different dependent variable, but the same regressors. In the first model (a), the ordinal dependent variable Yi1 gives information on the ability to manage their personal finances; in the second model (b), the dependent variable Yi2 assesses whether the student is able to effectively plan for short-term financial needs; in the third model (c), the dependent variable Yi3 evaluates the skill to effectively plan for long-term financial needs; and in the fourth model (d), Yi4 assesses the student’s ability to distinguish among different sources of non-traditional financing.

Age is the age of the respondents at the moment of the survey. Gender indicates the gender with which the students identified most. The variable Studies refers to the university (long-term) studying programmes in which the students are enrolled. Ac.Level stands for undergraduate or postgraduate studies. Country refers to the country of study at the moment of the survey. Traditional refers to specific short courses in entrepreneurship taken in a traditional face-to-face format. Digital refers to specific short courses in entrepreneurship taken in a digital format (synchronous or asynchronous). Internship refers to work experience through an internship contract. Work experience refers experience through a part- or full-time contract. Business established implies entrepreneurial experience in the past. Setting up business now refers to setting up a company at the moment of the survey. Specific studies stands for specific courses or seminars on financial management. β1-β12 are the coefficients associated with the above-mentioned independent variables, and β0 is the intercept. The descriptive statistics of the independent variables are provided in Table 1, while the statistics of the dependent variables are shown in Table 2.

Table 2Descriptive Statistics of Dependent Variables used in the Estimation Model

| Model (a): Managing personal finances | Model (b): Planning finances in the short-term | ||||||

| Scale | Responses, N | Responses, % | Scale | Responses, N | Responses, % | ||

| 1 | 20 | 2.3 | 1 | 19 | 2.2 | ||

| 2 | 29 | 3.3 | 2 | 46 | 5.2 | ||

| 3 | 79 | 9.0 | 3 | 109 | 12.4 | ||

| 4 | 127 | 14.4 | 4 | 184 | 20.9 | ||

| 5 | 217 | 24.6 | 5 | 206 | 23.4 | ||

| 6 | 220 | 25.0 | 6 | 166 | 18.8 | ||

| 7 | 189 | 21.5 | 7 | 151 | 17.1 | ||

| Total | 881 | 100 | Total | 881 | 100 | ||

| Model (c): Planning finance in the long-term | Model (d): Distinguishing among non-traditional funding sources | ||||||

| Scale | Responses, N | Responses, % | Scale | Responses, N | Responses, % | ||

| 1 | 30 | 3.4 | 1 | 163 | 18.5 | ||

| 2 | 56 | 6.4 | 2 | 146 | 16.6 | ||

| 3 | 87 | 9.9 | 3 | 162 | 18.4 | ||

| 4 | 184 | 20.9 | 4 | 208 | 23.6 | ||

| 5 | 216 | 24.5 | 5 | 122 | 13.8 | ||

| 6 | 170 | 19.3 | 6 | 52 | 5.9 | ||

| 7 | 138 | 15.7 | 7 | 28 | 3.2 | ||

| Total | 881 | 100 | Total | 881 | 100 | ||

| Descriptive statistics | |||||||

| (a) Managing personal finances | (b) Planning finances in the short-term | (c) Planning finances in the long-term | (d) Distinguish non-traditional funding sources | ||||

| Mean | 5.17 | 4.83 | 4.77 | 3.28 | |||

| Median | 5 | 5 | 5 | 3 | |||

| St. Dev. | 1.5 | 1.54 | 1.58 | 1.63 | |||

| Min | 1 | 1 | 1 | 1 | |||

| Max | 7 | 7 | 7 | 7 | |||

Source: authors' own work.

As a final note on the model variables, it should be emphasised that in the context of this study, which draws on a sample of university students, the inclusion of the above-mentioned independent variables, spanning socio-demographic, geo-demographic and topic-specific dimensions, is both intentional and theoretically grounded. Their selection reflects the need to capture the multifaceted nature of the phenomenon under investigation and ensures that the model remains valid and reflective of real-world dynamics.

The statistical analysis was done using R free software, version 4.3.2.

Findings

The results of the four estimations are shown in Table 3.

Table 3Estimation Results (Estimated Coefficients and their Standard Deviations)

| Independent variable | (a) personal finance management | (b) short-term planning | (c) long-term planning | (d) differentiation of non-traditional funding sources | ||||

| Coef. | St. Dev | Coef. | St. Dev | Coef. | St. Dev | Coef. | St. Dev | |

| Age | 0.0492 | (0.0129)*** | 0.0374 | (0.0119)*** | 0.0375 | (0.0111)*** | 0.0492 | (0.0197)** |

| Gender [M] | -0.3292 | (0.1434)** | 0.1510 | (0.1351) | 0.0135 | (0.1337) | 0.3320 | (0.1971)* |

| Gender [Others] | -0.6806 | (0.4800) | -0.7114 | (0.2807)** | -10098 | (0.4427)** | 0.6941 | (0.5745) |

| Studies [Economics] | -0.1721 | (1.0718) | -0.7767 | (0.9931) | -0.2542 | (1.0933) | -0.4466 | (1.4872) |

| Studies [Education] | -0.7907 | (1.1130) | -16201 | (1.0374) | -0.9844 | (1.1393) | -2.3029 | (1.5834) |

| Studies [Engineering] | -0.1815 | (1.0811) | -10781 | (1.0017) | -0.8300 | (1.1006) | -1.5497 | (1.5078) |

| Studies [Exact sciences] | 0.3978 | (1.2274) | -0.5513 | (1.1489) | 0.4689 | (1.2439) | -0.8201 | (1.6336) |

| Studies [Health Studies] | -0.5673 | (1.3227) | 0.3067 | (1.2713) | 0.9778 | (1.2739) | -0.0655 | (1.9109) |

| Studies [Humanities] | -1.0780 | (1.1134) | -16319 | (1.0341) | -12957 | (1.1341) | -2.5431 | (1.5768) |

| Studies [Law and Politics] | -0.3780 | (1.0986) | -0.8555 | (1.0173) | -0.8945 | (1.1206) | -1.1898 | (1.5255) |

| Studies [Social Sciences] | -0.5162 | (1.1221) | -0.8867 | (1.0417) | -0.7807 | (1.1395) | -0.9559 | (1.5439) |

| Country [Romania] | 0.1563 | (0.1672) | -0.4118 | (0.1583)*** | 0.0898 | (0.1568) | -0.8489 | (0.2400)*** |

| Country [Spain] | -0.4203 | (0.2297)* | -0.8591 | (0.2160)*** | -0.5174 | (0.2149)** | -1.5082 | (0.3581)*** |

| Ac.level [Postgrad] | -0.2213 | (0.2901) | 0.0629 | (0.2716) | 0.2188 | (0.2586) | 0.7098 | (0.4104)* |

| Traditional [Yes] | 0.4311 | (0.1807)** | 0.7018 | (0.1729)*** | 0.4017 | (0.1533)*** | 0.8481 | (0.2586)*** |

| Digital [Yes] | 0.5925 | (0.1759)*** | 0.4898 | (0.1603)*** | 0.7154 | (0.1649)*** | 1.0950 | (0.2644)*** |

| Internship [Yes] | 0.3399 | (0.1266)*** | 0.2018 | (0.1184)* | 0.1753 | (0.1173) | 0.3901 | (0.1687)** |

| Work experience [Yes] | 0.2890 | (0.1331)** | -0.0020 | (0.1259) | 0.1563 | (0.1244) | 0.5283 | (0.1842)*** |

| Business established [Yes] | 0.6551 | (0.2839)** | 0.1736 | (0.2632) | 0.3745 | (0.1965)* | 0.2453 | (0.3963) |

| Setting up business now [Yes] | 0.6885 | (0.2917)** | 0.6035 | (0.2643)** | 0.6772 | (0.2387)*** | 1.1139 | (0.3921)*** |

| Specific Studies [Yes] | -0.0442 | (0.1495) | 0.0423 | (0.1409) | 0.2235 | (0.1350)* | 0.2322 | (0.1906) |

Note. The coefficient and standard deviation of each variable is shown in brackets

*** means a significance level of 1%

** means a significance level of 5%

* means a significance level of 10%.

Source: authors' own work.

In the first estimation (a), focused on the students’ ability to manage personal finances, the results deliver a significant number of independent variables as significant. Age has a positive coefficient and is significant at 1%, meaning that the greater the age, the higher the probability of success in managing personal finances. Gender (M), which corresponds to male participants, has a negative sign and is significant at 5%. This variable is categorical, so the effect measured reflects the difference between male and female students. Country (Spain), another categorical variable referring to Spanish students compared to Polish ones, is significant at 10% with a negative coefficient. In this case, Spanish students are less likely to have well-developed personal financial management skills compared to Poles. Country (Romania), a categorical variable that helps to compare Romanian and Polish students, is not significant, so it is not very clear whether Romanians or Poles are stronger in personal finance management.

The variables Traditional (Yes) and Digital (Yes) are significant at 5% and 1%, respectively, both with a positive coefficient, which means that specific short courses in entrepreneurship, delivered in traditional and digital formats, significantly enhance students' chances of developing strong personal financial management skills. Internship (Yes), Work experience (Yes), Business established (Yes) and Setting up business now (Yes) are other independent variables that are significant and all positive, which underscores the notion that hands-on experience in a professional setting–whether through internships, employment or entrepreneurship–plays a crucial role in achieving success in personal finance management. The rest of the variables, as observed in the table, are not significant, so their influence is not relevant to the ability of personal finance management.

To improve the estimation of (a), a scale test is applied to determine if any of the independent variables generate high heterogeneity. The results show that Gender (M), Internship (Yes) and Business established (Yes) are significant. Comparing the first model with and without the scale test through ANOVA, significant differences between the two models are detected. In the second model, the scale test contributes to the explanatory capacity of the model, making it more robust and optimised. These results partially support the proposed hypotheses, except for H3, which states that there are no significant differences among students from different countries. In our case, Polish students are more likely to be more successful in managing personal finances than those from Spain.

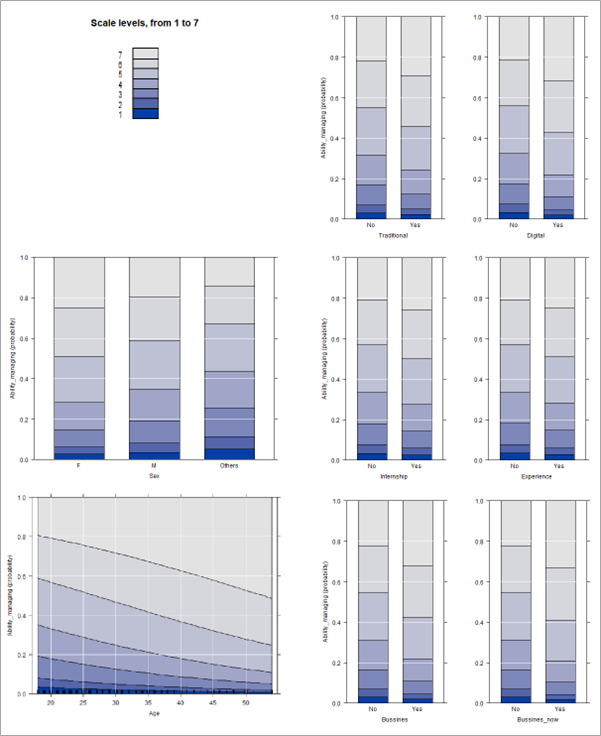

Additionally, there are several charts obtained from the estimation of model (a), showing the predictor effect of the significant independent variables on the development of personal financial management skills (see Figure 1). The complete figure contains different graphs, each corresponding to an independent variable identified as significant in the model estimation (a), and allowing for a comparison of participants’ responses across the different variables. For instance, the variable Traditional (Yes), which refers to whether participants have taken a traditional course (‘yes’ and ‘no’), shows the effects using a colour gradient (ranging from dark blue for weaker influence to lighter blue for stronger influence). These colours represent the levels of a 1 to 7 Likert scale used to measure self-reported personal finance management skills. As shown, the influence range (i.e. the height of the bars), particularly for the top three scale levels, is greater among participants who have taken a traditional course compared to those who have not. This pattern of interpretation applies similarly to the other graphs included in Figure 1.

Figure 1

Predictor Effect Plot, Model (a)

Source: authors’ own work.

In model (b), which assesses planning skills of university students for short-term financial needs, Age comes out significant and positive, suggesting that as in the previous model, older students are more likely to have stronger skills in short-term financial planning. The variables Gender (Others), Country (Romania) and Country (Spain) are significant, with a negative coefficient. University students of non-binary gender and those studying in Romania and Spain compared to Poland are therefore likely to be less skilled in short-term financial planning. Traditional (Yes), Digital (Yes), Internship (Yes) and Setting up business now (Yes) are significant and positive. Similar to the results of model (a), the experience the students had through specific business courses (traditional and digital), internships and setting up a business at the moment of the survey are likely to be more successful by planning for short-term financial needs.

The application of the scale test shows that the variable Gender is the only one that generates the greatest variability in the model. Once again, after comparing the models with and without the scaling test, the estimation with the scaling test is significant, optimising the estimation of model (b) presented in this study. These findings, with the exception of H3, partially validate the proposed hypotheses as in model (a).

Estimation (c) regarding planning for long-term financial needs shows that the variables Age, Gender (Others) and Country (Spain) are significant, while Age is positive and Gender (Others) and Country (Spain) are negative. Thus, older students seem to be more successful in long-term financial planning, while students of non-binary gender and those studying in Spain are less skilled. In addition, Traditional (Yes), Digital (Yes), Business established (Yes), Setting up a business now (Yes) and Specific studies (Yes) are significant and positive. Specific courses in entrepreneurship, both in traditional and digital formats, specific studies on financial management, and entrepreneurial experience therefore increase the probability of showing stronger skills in planning for long-term financial needs. In this estimation, the variables with the greatest variability are Business established (Yes) and Traditional (Yes), as shown by the scale test. Using ANOVA helps identify significant differences between models with and without scale tests, indicating that the model with scale tests is robust and optimised. Once again, this analysis finds partial support for all hypotheses, except H3.

The model (d), focused on the ability of students to differentiate among non-traditional sources of financing, reveals that Age is significant and positive, with older students, as in the three previous estimations, likely to better distinguish among the alternative funding sources. Gender (M) is also significant and positive, although here, unlike the result of model (a), women seem to be less skilled than men. Country (Romania) and Country (Spain) are significant with negative coefficients, which means that Spanish and Romanian students are less likely to distinguish among non-traditional funding sources than Polish students. The variables Ac.level (Master), Traditional (Yes), Digital (Yes), Internship (Yes), Work experience (Yes) and Setting up business now (Yes) are significant and positive, meaning that those who study in Master's and PhD programmes take specific business courses (traditional and digital), while those with work and recent entrepreneurial experience likely to be quite knowledgeable about alternative funding sources. The scale test shows that in the estimation of model (d), the excessive variability is generated by the variable Age. As in the previous three models, the ANOVA test reveals that the model with the scale test is significant, showing the greatest explanatory capacity. These findings partially validate the hypotheses, except H2 and H3.

As in the first model (a), the remaining three models – (b), (c), and (d) – have additional charts, which, due to space constraints, are not included in this paper but are available upon request.

Discussion

This empirical study utilizes a sample drawn from three European countries, each representing different socioeconomic contexts. As shown through various official reports, financial literacy in most countries around the globe, regardless of their macroeconomic level, is quite low (Demirgüç-Kunt, 2021; Lusardi & Messy, 2023; OECD, 2020). However, the analysis of this study reveals that Polish students tend to show stronger levels of several skills associated with personal financial management than Spanish and Romanian students. Interestingly, this finding is similar to that shown by Ergün (2018) who compared the level of financial literacy among university students in eight European countries.

The finding that Polish students outperform their Romanian and Spanish peers in managing personal finance raises further reflection. There are several factors which may contribute to cross-country differences in financial behaviour. Poland, for instance, has actively integrated financial education into its national curriculum and has seen strong involvement from institutions like the National Bank of Poland in promoting financial literacy. Additionally, Poland's relatively higher GDP per capita compared to Romania, and a more stable economic trajectory in recent decades, may provide students with greater access to financial tools and knowledge. Cultural factors also play a role: for example, Poland scores higher on long-term orientation (one of Hofstede’s dimensions), which aligns with prudent financial planning. The family model in Poland may encourage earlier financial independence, while Romanian and Spanish students might experience longer economic dependence on parents. Moreover, the post-communist experience in Poland differs significantly from Romania’s and Spain’s (Spain has a different political and economic trajectory), possibly affecting financial trust and behaviour in nuanced ways. Nevertheless, caution should be taken in extending this explanation beyond the countries studied as other national contexts are very different.

This study also highlights that specific training in finance is essential for enhancing the skills under analysis. This result is in line with the insights provided by other studies on the university student population (Aydin & Selcuk, 2019; Narmadity & Sahid, 2023). Remarkably, it is courses in business and entrepreneurship rather than studies in finance that significantly increase the probability of developing higher skills in personal financial management among university students.

Regarding gender, as expected, female students are likely to be more skilled in personal financial management than their male counterparts. This result contradicts the findings consistently reported in the literature since the early 2000s (Agnew & Cameron-Agnew, 2015; Garg & Singh, 2018; Wee & Goy, 2022). However, some studies suggest that while women may have lower financial literacy, they often demonstrate better financial practices than men (Gudjonsson et al., 2022). The only time female students seem to be less knowledgeable is about alternative funding sources. Nevertheless, it is worth noting that our study’s results also reveal significant heterogeneity influenced by the gender variable.

Work experience, either through direct employment, internships, or involvement in entrepreneurship, appears to be crucial for the financial literacy of European university students. This hands-on business experience helps them to acquire new knowledge and skills applying them in practice. While Sugeng and Suryani (2020) emphasize the importance of in-class problem-based learning for subjects related to financial management, we stress the relevance of practice-based learning for consolidating finance management-related skills. This idea aligns with other studies that highlight that financial education impacts directly financial knowledge but not always financial behaviour of university students (Johan et al., 2021) and that work experience enhances students’ financial management skills (Nano & Mema, 2017). In addition, it is important to note that previous studies relate internships to larger entrepreneurship since these experiences inspire students to start their businesses (Weible, 2009) and to higher employment rates and financial stability because they start earning income (Kapareliotis et al., 2019; Nunley et al., 2016).

Studies on financial literacy among university students have also been conducted outside Europe. In Pakistan, an analysis of university students enrolled in non-business or non-commerce programmes revealed an average level of financial knowledge. However, the study highlighted a strong and positive influence of factors such as family recommendations, high household income, enrolment in finance-related courses, and prior banking experience (Liaqat et al., 2021). In the United Arab Emirates, research on the multidimensional aspects of financial literacy among university students yielded similar findings. It further identified disadvantaged groups, including women, students who had not completed their undergraduate studies, and those enrolled in non-scientific fields (Douissa, 2020).

A study by Vaghela et al. (2023) on Indian university students extended beyond merely assessing financial knowledge. It explored the interrelationships between financial knowledge, attitudes, and behaviour, revealing a direct and significant connection among these three dimensions. Similar investigations have used samples of university students in the United States (Hanson, 2022), as well as in Mexico and Colombia (Ramos-Hernández et al., 2020), in an attempt to find what factors impact mostly the level of financial knowledge of students. Additionally, Faulkner (2016) reflects on the state of financial education in the United States, advocating for the inclusion of targeted financial literature in educational programming by librarians.

Conclusions

Through the empirical study presented here, the authors try to determine the likelihood that factors such as age, gender, country of study, educational background, and entrepreneurial experience are related to enhancing the basic capabilities that denote higher levels of financial literacy as perceived by European university students. The sample comes from several universities located in Spain, Romania, and Poland and includes 881 undergraduate and postgraduate students from different academic programmes.

Based on the literature review, the authors proposed six hypotheses that suggest the likelihood of high financial literacy among university students depending on the age, gender, country of study, specific education, and work and entrepreneurial experience.

The applied methodology for analysing the data obtained through an anonymous survey is based on cumulative regression models, optimised with a location-scale test because of the high heterogeneity observed in the characteristics of the sampled participants. The analysis is done through four estimations which help to determine a strong relationship between the independent variables and personal financial management measured through the perception of university students of their level of four basic skills related to financial management. The statistical analysis was done using the free software R, version 4.3.2.

The main findings show several determinants that in one way or another shape the financial literacy of university students. First, age is an important factor that increases the probability of having good skills related to personal financial management, in the broad sense of the term. Secondly, it is gender, showing that female participants, generally, are the most skilled in this respect. Thirdly, the country where students study is also related to the development of financial literacy, with Poland having the highest development and Spain the lowest among the three European countries taken in this study. Fourthly, specific training in financial management, especially, short-term courses, is directly related to the level of capability of managing personal finance. Fifth and finally, the authors highlight work (employment contract or internship) as well as entrepreneurial experience as factors that are positively related to the personal financial management skills of university students. Interestingly, the type of general studies, such as Economics, Business Administration, Engineering, Health or Law, just to give a few examples, are not at all related to the ability to manage personal finances.

These results are similar in all four estimations, with the exception that in the fourth estimation, focused on the ability of students to differentiate among non-traditional sources of financing, female participants are shown to be the least skilled, while postgraduate students as the most prepared and somewhat knowledgeable about non-traditional sources of finance. The findings support the proposed hypotheses, except for hypothesis 3, which suggested that there were no significant differences between the abilities of students from different countries.

Having shown that our results are consistent with the extant literature, this study underscores the critical role of practical experience and targeted financial education in enhancing financial literacy among university students, highlighting the need for tailored educational programmes to address the diverse needs of different student groups. In addition, current teaching methods and tools can actively use advanced technology or artificial intelligence that could be of great help for students to put theoretical knowledge into practice through quasi-real scenarios, which would surely help them to build a positive financial attitude, prepare them to make informed financial decisions, and prevent their financial exclusion in an increasingly complex and changing world.

The results presented here have important implications for educational policy. Given the social and economic costs associated with poor financial literacy (over-indebtedness, poor saving behaviour, and limited access to financial products), higher education institutions should strongly consider integrating structured and tailored financial education modules into their curricula. This highlights the value of experiential learning in bridging the gap between theoretical knowledge and real-world financial decision-making, and therefore engaging students with practical simulations and real-world case studies into financial education can significantly enhance its effectiveness and relevance for students across disciplines.

Nevertheless, this study is not without limitations. The data is based on students’ self-perceptions of their financial skills, with the possibility of response bias. Future studies could complement this approach with objective assessments or longitudinal tracking of financial behaviours. Additionally, while the study covers three European countries, the findings should not be generalised to other national contexts, particularly to countries such as France, Germany, Sweden or the United Kingdom, as these countries differ significantly in terms of socio-economic development, financial education frameworks, and cultural attitudes towards money. Additional comparative research would be needed to explore whether the determinants identified here can be applied similarly across Europe or other regions.

Finally, given that one of the findings of this empirical study indicates that complementary education in entrepreneurship and business management, rather than in finance, has a significant influence on students’ financial management skills, further research in this area is warranted.

This study is part of the project FINANCEn_LAB (project ID “Digital Simulator for Entrepreneurial Finance” (FINANCEn_LAB), reference number: 2020-1-ES01-KA226-HE-095810), funded through Erasmus+, Call 2020 Round 1 KA2 - Cooperation for innovation and the exchange of good practices, KA226 - Partnerships for Digital Education Readiness.

References

- Agnew, S., & Cameron‐Agnew, T. (2015). The influence of consumer socialisation in the home on gender differences in financial literacy. International Journal of Consumer Studies, 39(6), 630-638. https://doi.org/10.1111/ijcs.12179

- Ahmaddien, I., Abdi, M., Trisnawati, E. & Ratnawati, R. (2019). Determinants of students financial literacy: Student survey of faculty of economics Sangga Buana University, Bandung. Proceedings of the First International Conference on Administration Science (ICAS 2019). Published by Atlantis Press. https://doi.org/10.2991/icas-19.2019.62

- Andarsari, P. R., & Ningtyas, M. N. (2019). The role of financial literacy on financial behavior. Journal of Accounting and Business Education, 4(1), 24-33. https://doi.org/10.26675/jabe.v4i1.8524

- Andreeva, G., Nikitina, O., Pavlova, L., & Sokolova, E. (2020). Managing the formation of the individual financial culture of university students. SHS Web of Conferences. https://doi.org/10.1051/shsconf/20207902002

- Audretsch, D. B. (2017). Entrepreneurship and universities. International Journal of Entrepreneurship and Small Business, 31(1), 4-11. https://doi.org/10.1504/IJESB.2017.083802

- Aydin, A. E., & Selcuk, E. A. (2019). An investigation of financial literacy, money ethics and time preferences among college students: A structural equation model. International Journal of Bank Marketing, 37(3), 880-900. https://doi.org/10.1108/IJBM-05-2018-0120

- Bonini, S., Capizzi, V., & Cumming, D. (2019). Emerging trends in entrepreneurial finance. Venture Capital, 21(2-3), 133-136. https://doi.org/10.1080/13691066.2019.1607167

- Bruhn, M., Leão, L., Legovini, A., Marchetti, R., & Zia, B. (2016). The impact of high school financial education: Evidence from a large-scale evaluation in Brazil. American Economic Journal: Applied Economics, 8(4), 256-295. https://doi.org/10.1257/APP.20150149

- Chabaefe, N. N., & Qutieshat, A. (2024). Financial literacy, financial education and financial experience: Conceptual framework. International Journal of Economics and Financial Issues, 14(4), 44-55. https://doi.org/10.32479/ijefi.15627

- Chmelíková, B. (2015). Financial literacy of students of finance: An empirical study from the Czech Republic. International Journal of Economics and Management Engineering, 9(12), 4233-4236. https://doi.org/10.5281/zenodo.1110427

- Cho, Y., & Lee, J. (2018). Entrepreneurial orientation, entrepreneurial education and performance. Asia Pacific Journal of Innovation and Entrepreneurship, 12(2), 124-134. https://doi.org/10.1108/APJIE-05-2018-0028

- Cumming, D., & Johan, S. (2017). The problems with and promise of entrepreneurial finance. Strategic Entrepreneurship Journal, 11(3), 357-370. https://doi.org/10.1002/sej.1265

- Dahiya, M., Özen, E., & Yadav, K. (2023). The financial literacy of college students: Evidence from India. CMU: Journal of Social Sciences and Humanities, 10(1). https://doi.org./10.12982/CMUJASR.2023.009

- del Rosario Arambulo-Dolorier, E., Gonzales-Pariona, J. D. M., Cordova-Buiza, F., Lujan-Valencia, S., & Gutierrez-Aguilar, O. (2024). Financial education for university students: A personal leadership tool. In B. Alareeni, & A. Hamdan (Eds.), Technology: Toward Business. Proceedings of the International Conference on Business and Technology (ICBT2023), Volume 4 (pp. 217-227). Springer.

- Demirgüç-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2021). The Global Findex Database 2021. Financial inclusion, digital payments, and resiliance in the age of COVID-19. The World Bank. http://documents.worldbank.org/curated/en/099833507072223098

- Douissa, I. B. (2020). Factors affecting College students’ multidimensional financial literacy in the Middle East. International Review of Economics Education, 35, 100173. https://doi.org/10.1016/j.iree.2019.100173

- Ergün, K. (2018). Financial literacy among university students: A study in eight European countries. International Journal of Consumer Studies, 42(1), 2-15. https://doi.org/10.1111/ijcs.12408

- Ergün, K. (2021). Determinants of positive financial behaviors: A study among university students. In D. Procházka (Ed.), Digitalization in Finance and Accounting. 20th Annual Conference on Finance and Accounting (ACFA 2019) (pp. 331-341). Springer.

- Faulkner, A. E. (2016). Financial literacy education in the United States: Library programming versus popular personal finance literature. Reference and User Services Quarterly, 56(2), 116-125. https://www.jstor.org/stable/90009919

- Ferreras-Garcia, R., Sales-Zaguirre, J., & Serradell-López, E. (2021). Developing entrepreneurial competencies in higher education: a structural model approach. Education+ Training, 63(5), 720-743. https://doi.org/10.1108/ET-09-2020-0257

- Fornero, E., & Prete, A. L. (2019). Voting in the aftermath of a pension reform: The role of financial literacy. Journal of Pension Economics & Finance, 18(1), 1-30. https://doi.org/10.1017/S1474747218000185

- Fornero, E., & Prete, A. L. (2023). Financial education: From better personal finance to improved citizenship. Journal of Financial Literacy and Wellbeing, 1(1), 12-27. https://doi.org/10.1017/flw.2023.7

- Garg, N. & Singh, S. (2018). Financial literacy among youth. International Journal of Social Economies, 45(1), 173-186. https://doi.org/10.1108/IJSE-11-2016-0303

- García Mata, O. (2021). The effect of financial literacy and gender on retirement planning among young adults. International Journal of Bank Marketing, 39(7), 1068-1090. http://dx.doi.org/10.1108/IJBM-10-2020-0518

- Gudjonsson, S., Minelgaite, I., Kristinsson, K., & Pálsdóttir, S. (2022). Financial literacy and gender differences: Women choose people while men choose things? Administrative Sciences, 12(4), 179. https://doi.org/10.3390/admsci12040179

- Hanson, T. A. (2022). Family communication, privacy orientation, & financial literacy: A survey of US college students. Journal of Risk and Financial Management, 15(11), 528. https://doi.org/10.3390/jrfm15110528

- Harrington, C., Smith, W., & Bauer, R. (2016). Influencing business student intent to use a personal budget. The Accounting Educators' Journal, 26, 135-153. https://www.aejournal.com/ojs/index.php/aej/article/view/342

- Harvey, M. (2019). Impact of financial education mandates on younger consumers' use of alternative financial services. Journal of Consumer Affairs, 53(3), 731-769. https://doi.org/10.1111/joca.12242

- Herdjiono, I., Peka, H. P., Ilyas, I., Septarini, D. F., Setyawati, C. H., & Irianto, O. (2018, October). Gender gap in financial knowledge, financial attitude and financial behavior. In Proceedings of the 1st International Conference on Social Sciences (ICSS 2018) (pp. 1363-1366). Atlantis Press. https://doi.org/10.2991/icss-18.2018.287

- Huang, L. (2016). Personal financial planning for college graduates. Technology and Investment, 7, 123-134. https://doi.org/10.4236/TI.2016.73014

- Huth, C., & Kurscheidt, M. (2022). Crowdfunding as financing tool of semi-professional sports clubs: evidence on funders’ preferences and typologies. Athens Journal of Sports, 9(3), 135-160. https://doi.org/10.30958/ajspo.9-3-2

- Ingale, K. K., & Paluri, R. A. (2022). Financial literacy and financial behaviour: A bibliometric analysis. Review of Behavioral Finance, 14(1), 130-154. https://doi.org/10.1108/RBF-06-2020-0141

- Johan, I., Rowlingson, K., & Appleyard, L. (2021). The effect of personal finance education on the financial knowledge, attitudes and behaviour of university students in Indonesia. Journal of Family and Economic Issues, 42, 351-367. https://doi.org/10.1007/S10834-020-09721-9

- Kaiser, T., & Menkhoff, L. (2020). Financial education in schools: A meta-analysis of experimental studies. Economics of Education Review, 78, 101930. https://doi.org./10.1016/J.ECONEDUREV.2019.101930

- Kapareliotis, I., Voutsina, K., & Patsiotis, A. (2019). Internship and employability prospects: assessing student’s work readiness. Higher Education, Skills and Work-Based Learning, 9(4), 538-549. https://doi.org/10.1108/HESWBL-08-2018-0086

- Katenova, M., & Lee, S. H. (2018). Financial literacy: the case of Kimep University students. Turkish Online Journal of Design, Art & Communication, 8, 2394-2403. http://www.tojdac.org/tojdac/VOLUME8-SPTMSPCL_files/tojdac_v080SSE309.pdf

- Khalisharani, H., Johan, I. R., & Sabri, M. F. (2022). The influence of financial literacy and attitude towards financial behaviour amongst undergraduate students: A cross-country evidence. Pertanika Journal of Social Sciences & Humanities, 30(2). https://doi.org/10.47836/pjssh.30.2.03

- Kirsten, C. L. (2018). The role of financial management training in developing skills and financial self-efficacy. The Southern African Journal of Entrepreneurship and Small Business Management, 10(1), 1-8. https://doi.org/10.4102/sajesbm.v10i1.211

- Liaqat, F., Mahmood, K., & Ali, F. H. (2021). Demographic and socio-economic differences in financial information literacy among university students. Information Development, 37(3), 376-388. https://doi.org/10.1177/0266666920939601

- Liu, F. (2021). The impact of gender on financial goal setting and planning. International Journal of Economics and Finance, 13(5), 1-36. https://doi.org/10.5539/ijef.v13n5p36

- Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1-8. https://doi.org/10.1186/s41937-019-0027-5

- Lusardi, A., & Messy, F.-A. (2023). The importance of financial literacy and its impact on financial wellbeing. Journal of Financial Literacy and Wellbeing, 1(1), 1-11. https://doi.org/10.1017/flw.2023.8

- McCullagh, P. (1980). Regression models for ordinal data. Journal of the Royal Statistical Society: Series B (Methodological), 42(2), 109-127. https://doi.org/10.1111/j.2517-6161.1980.tb01109.x

- Mireku, K., Appiah, F., & Agana, J. A. (2023). Is there a link between financial literacy and financial behaviour? Cogent Economics & Finance, 11(1), 2188712. https://doi.org/10.1080/23322039.2023.2188712

- Mitchell, O. S., & Lusardi, A. (2022). Financial literacy and financial behavior at older ages. In D. E. Bloom, A. Sousa-Poza, & U. Sunde (Eds.), The routledge handbook of the economics of ageing (pp. 553-565). Routledge. http://dx.doi.org/10.2139/ssrn.4006687

- Nano, D., & Mema, B. (2017). The impact of work experience on students' financial behaviour. Proceedings of the 2017 1st International Conference on E-Education, E-Business and E-Technology, 57-60. https://doi.org/10.1145/3141151.3141162

- Narmaditya, B. S., & Sahid, S. (2023). Financial literacy in family and economic behavior of university students: A systematic literature review. The Journal of Behavioral Science, 18(1), 114-128. https://so06.tci-thaijo.org/index.php/IJBS/article/view/257900

- Nunley, J., Pugh, A., Romero, N., & Seals, R., (2016). College major, internship experience, and employment opportunities: Estimates from a résumé audit. Labour Economics, 38, 37-46. https://doi.org/10.1016/J.LABECO.2015.11.002

- OECD. (2014). PISA 2012 Results: Students and Money (Volume VI): Financial Literacy Skills for the 21st Century. PISA, OECD Publishing. https://doi.org/10.1787/9789264208094-en

- OECD. (2017). PISA 2015 Results (Volume IV): Students' Financial Literacy. PISA, OECD Publishing. https://doi.org/10.1787/9789264270282-en

- OECD. (2020). PISA 2018 Results (Volume IV): Are Students Smart about Money? PISA, OECD Publishing. https://doi.org/10.1787/48ebd1ba-en

- OECD. (2024). Recommendation of the Council on Financial Literacy. OECD Leagal Instruments, 0461. https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0461

- Okičić, J. (2019). The relationship between decision-making style of entrepreneurs and their financial literacy. In Innovation Management, Entrepreneurship and Sustainability (IMES 2019). Proceedings of the 7th International Conference Innovation Management, Entrepreneurship and Sustainability (IMES 2019) (pp. 655-668). Vysoká škola ekonomická v Praze. https://www.ceeol.com/search/chapter-detail?id=785011

- Owusu, G. M. Y., Koomson, T. A. A., Boateng, A. A., & Donkor, G. N. A. (2023). The nexus amongst financial literacy, financial behaviour and financial well-being of professional footballers in Ghana. Managing Sport and Leisure, 1-16. https://doi.org/10.1080/23750472.2023.2248150

- Pavković, A., Anđelinović, M., & Mišević, D. (2018). Measuring financial literacy of university students. Croatian Operational Research Review, 9(1), 87-97. https://doi.org/10.17535/crorr.2018.0008

- Polák, J., Kozubíková, Z., & Kozubík, A. (2020). Financial literacy of university students measured by P-Fin Index. In The 6th International Scientific Conference–ERAZ, 61-69. http://dx.doi.org/10.31410/ERAZ.S.P.2020.61

- Potrich, A. C. G., Vieira, K. M., & Mendes-Da-Silva, W. (2016). Development of a financial literacy model for university students. Management Research Review, 39(3), 356-376. https://doi.org/10.1108/MRR-06-2014-0143

- Ramos-Hernández, J. J., García-Santillán, A., & Molchanova, V. (2020). Financial literacy level on college students: A comparative descriptive analysis between Mexico and Colombia. European Journal of Contemporary Education, 9(1), 126-144. https://doi.org/10.13187/ejced.2020.1.126

- Sugeng, B., & Suryani, A. W. (2020). Enhancing the learning performance of passive learners in a Financial Management class using Problem-Based Learning. Journal of University Teaching and Learning Practice, 17(1), 1-21. https://doi.org/10.53761/1.17.1.5

- Sugiyanto, T., Radianto, W. E., Efrata, T. C., & Dewi, L. (2019, October). Financial literacy, financial attitude, and financial behavior of young pioneering business entrepreneurs. In Proceedings of the 2019 International Conference on Organizational Innovation (ICOI 2019) (pp. 353-358). Atlantis Press. https://doi.org/10.2991/icoi-19.2019.60

- Susanti, & Hardini, H. T. (2018). Gender, academic achievement, and ownership of ATM as predictors of accounting students’ financial literacy. IOP Conference Series: Materials Science and Engineering, 296(1), 012031. https://doi.org/10.1088/1757-899X/296/1/012031

- Tutz, G. (2022). Ordinal regression: A review and a taxonomy of models. WIREs Computational Statistics, 14(2), e1545. https://doi.org/10.1002/wics.1545

- Vaghela, P. S., Kapadia, J. M., Patel, H. R., & Patil, A. G. (2023). Effect of financial literacy and attitude on financial behavior among university students. Indian Journal of Finance, 17(8), 43-57. https://doi.org/10.17010/ijf/2023/v17i8/173010

- Valencia-Arias, A., Arango-Botero, D., & Sánchez-Torres, J. A. (2022). Promoting entrepreneurship based on university students' perceptions of entrepreneurial attitude, university environment, entrepreneurial culture and entrepreneurial training. Higher Education, Skills and Work-Based Learning, 12(2), 328-345. https://doi.org/10.1108/HESWBL-07-2020-0169

- Wagner, J., & Walstad, W. B. (2018). The effects of financial education on short‐term and long‐term financial behaviors. Journal of Consumer Affairs, 53(1), 234-259. https://doi.org/10.1111/joca.12210

- Wee, L. L. M., & Goy, S. C. (2022). The effects of ethnicity, gender and parental financial socialisation on financial knowledge among Gen Z: the case of Sarawak, Malaysia. International Journal of Social Economics, 49(9), 1349-1367. https://doi.org/10.1108/IJSE-02-2021-0114

- Weible, R. (2009). Are universities reaping the available benefits internship programs offer? Journal of Education for Business, 85(2), 59-63. https://doi.org/10.1080/08832320903252397

- Xiao, J. J., & O'Neill, B. (2016). Consumer financial education and financial capability. International Journal of Consumer Studies, 40(6), 712-721. https://doi.org/10.1111/ijcs.12285

- Yahaya, R., Zainol, Z., Osman, J. H., Abidin, Z., & Ismail, R. (2019). The effect of financial knowledge and financial attitudes on financial behavior among university students. International Journal of Academic Research in Business and Social Sciences, 9(8), 22-32. http://dx.doi.org/10.6007/IJARBSS/v9-i8/6205

https://orcid.org/0000-0002-5865-2082

https://orcid.org/0000-0002-5865-2082