Informacje o artykule

DOI: https://www.doi.org/10.15219/em92.1544

W wersji drukowanej czasopisma artykuł znajduje się na s. 16-25.

Pobierz artykuł w wersji PDF

Pobierz artykuł w wersji PDF

Abstract in English

Abstract in English

Jak cytować

Grabińska, B., Andrzejewski, M., & Grabiński, K. (2021). The students' and graduates' perception of the potential usefulness of Artificial Intelligence (AI) in the academic curricula of Finance and Accounting Courses. e-mentor, 5(92), 16-25.

E-mentor nr 5 (92) / 2021

Spis treści artykułu

- Abstract

- Introduction

- New technologies driving fundamental change in the accounting and finance professions

- Relevant theories in the context of implementing AI technologies in the university curricula

- Sample selection, research design and results

- Discussion and conclusions

- References

Informacje o autorach

The students' and graduates' perception of the potential usefulness of Artificial Intelligence (AI) in the academic curricula of Finance and Accounting Courses

Barbara Grabińska, Mariusz Andrzejewski, Konrad Grabiński

Abstract

The application of computer-based technologies in academic education has at least three decades of history and experience. In some study fields, it has been present since the very beginning, while in others it has become a necessity only in recent years. The ongoing technological revolution is disrupting the traditional professions with fundamental changes and – in some cases – even with the threat of disappearance of jobs. The finance and accounting professions are expected to undergo a technological change in the near future. While the changes are visible at the corporate level, university education seems to lag one step behind. We conducted a study among the students and graduates of the finance and accounting line of studies at the Cracow University of Economics. Using regression analysis, we investigate the perception of the usefulness of courses providing knowledge on new technologies like Artificial Intelligence (AI). We use a unique Polish setting, which is a leader in terms of outsourcing services. Our findings show that both students and graduates are aware of the importance of technological change. The courses teaching basic subjects are essential, but the current expectations are much higher in terms of the application of new technology based on AI in finance and accounting.

Keywords: higher education, finance and accounting education, student preferences, university curricula, Artificial Intelligence

Introduction

The technological revolution is disrupting traditional professions with fundamental change and, in some cases, even with the threat of evaporation. In some sectors, computer-based technologies are well established, while in others, rapid progress has just gained momentum (OECD, 2017). This applies for instance to engineering, management, health services (doctors), pharmacy, security services, retail services, the military sector (soldiers), and accounting and finance. A very important element of support in this aspect is academic education, which may embrace the change and prepare the younger generation for future challenges. For example, engineering studies have been based for many years on computer technologies. In the case of other study fields like finance and accounting, the exploitation of computer-based technologies, especially Artificial Intelligence (AI)-related courses, has not been extensive so far. However, this is deemed to be changed as skills related to AI appear to be in demand across many sectors of the economy.

We have chosen education aimed at finance and accounting professions as our focal point because it is expected to undergo fundamental technological changes in the near future. The role of new technologies, especially Artificial Intelligence, is raised in this context by many experts (Goldstein, 2005; Hwang et al., 2020; Yap & Drye, 2018; Zawacki-Richter et al., 2019). Consequently, the requirements of employers regarding the expected competencies and skills of job applicants are changing. As indicated by Squicciarini and Nachtigall (2021), the sector of "Financial and Insurance Activities" (together with "Information and Communication" and "Professional, Scientific and Technical Activities") is among the most AI-intensive jobs.

Unfortunately, higher education curricula lag behind this change. As the EU reports on education prospects, while universities enhance their graduates' employability, their curricula tend to adapt slowly to the labour market's changing needs (European Commission, 2012, 2018). University policymakers often underestimate the importance of technological change. They are sometimes unaware of which technology, skills, and competencies are or will be crucial in the near future for a given profession and related field of study. We aim to identify key computer-based technologies which are not yet but should be adopted in the university curricula in the context of finance and accounting courses. We are doing this by preparing and analyzing the questionnaire performed on current students and graduates of the Cracow University of Economics. We compare the current students and graduates' results to show how the perception has changed after several years of working experience. We assume the graduates' professional experience may reveal the shortcomings of academic curricula regarding the requirements of accounting and finance professions. Graduates' perception is also a good signpost showing which competencies and skills are the most needed in the labour market but were not provided in the university curricula.

Firstly, we conjecture that graduates with a long professional experience working in the international environment are more inclined to seek knowledge on the newest technologies. For that reason, we have chosen AI as the most modern and revolutionary technology, encompassing numerous subcategories of technology. Secondly, we hypothesize that graduates are more inclined to learn about AI than current students. In the same vein, the results suggest that graduates appreciate more knowledge and skills on AI technology in comparison to students.

The study focuses on students and graduates' perspectives, whether technological change is necessary, and how it should be reflected in the university curriculum. Al-Htaybat et al. (2018) performed a similar study in terms of the concept. However, it was based on educators' perceptions. We extend this line of reasoning by adding the students and graduates' perspectives.

The paper is organized as follows. We start with a literature review describing key technologies related to the accounting and finance profession. This is followed by the relevant theories in the context of implementing AI technologies in the university curricula. Next, we present sample selection, research design, and results, and we conclude the paper by presenting discussion points and closing remarks.

New technologies driving fundamental change in the accounting and finance professions

The accounting and finance professions are undergoing fundamental changes driven by many factors, one of which is the emergence and application of new technologies. Interviews with finance and accounting graduates and conducted questionnaires show that some of them appear repeatedly. Expert systems, robotics, machine learning, big data, data mining, and artificial intelligence are the terms mentioned most often. In the academic curricula, in terms of technology, what can be found are computer spreadsheets (i.e. MS Excel) and expert systems, but rarely any other new computer-based technology. Spreadsheets and expert systems are well known in education and do not need additional explanation. The other terms are not easily defined, and sometimes the difference is difficult to grasp. We have defined those terms from the perspective of their applications in the accounting and finance professions.

AI is defined as the process through which computers and programs perform tasks by simulating intelligent human behaviours by learning from experience and adjusting to new information. Vetter (2021) notes that AI is a term of broad meaning. Literature differentiates between broad and narrow AI. To date broad AI is still at the theoretical or even sci-fi level. In the narrow sense, AI refers to computers' ability to perform specific tasks and the aim of increasing organizational efficiency through automation. The most frequently cited examples of AI applications demonstrated in literature (Duan et al., 2019) are decision-making, analysis, estimation, judgments, predictions, natural language processing, recommendation, and inference. Nowadays, the main "product" of AI is intelligent services, simulating human behaviour (Hwang et al., 2020). These are used in such distant fields as medicine and financial services.

Patrick (2020) provides the following example of a simple calculator and image-recognition technology to understand the essential principle of AI. The calculator performs simple mathematical calculations and, by doing that, emulates human behaviour and potentially meets the definition of AI. However, a human must provide input and select a proper function to perform calculations. In the case of image-recognition technology, the AI program scans a parking lot, differentiates between cars and motorcycles, and provides accurate counts of each category. The task requires identifying the shapes and characteristics of the vehicles, so it involves intelligent decision-making. Petkov (2020) formulates the definition of AI from the accounting perspective as a system that can perform some of the accounting tasks normally requiring human intelligence. The main job of AI in accounting is to learn from company operations. Based on that, AI is expected to identify, sort and process information aimed at forming accounting judgments and estimates, which forms a decision-making process.

Nowadays, AI technology is gaining momentum in transforming business, providing even more useful technologies like AI security, the democratization of technology, hyper-automation and deep learning techniques like image recognition, voice recognition, and natural language processing. Some of them are of special importance for accounting and finance, including machine learning, robotics, big data, etc., which can be perceived as derivation technologies growing out of the common core.

Importantly, AI is predicted to have a huge impact on the labour market, creating opportunities and threats to jobs. On the one hand, it is expected to complement individuals in some tasks and generate demand for new highly specialized jobs, but on the other, it is expected to replace humans in some operations, transform the system of work organization, and create challenges in terms of new skills and competencies expected from the employee. According to a PwC Report by Hawksworth et al. (2018), 30% of jobs across 29 studied countries will be at risk of automation by 2030. The sector breakdown presented in this report indicates that the financial and insurance industry is facing a significant risk of individuals being replaced by technologies. Analyzing the impact of automation on international job markets, Hawksworth et al. (2018) identify three waves. The first one - algorithmic wave (up until the early 2020s.) - is based on automation of basic computational tasks and simple analysis of structured data, which is expected to affect the financial services sector. The second - augmentation wave (up until the late 2020s.) - will affect clerical support and decision-making and robotic tasks in semi-controlled environments. The last - autonomous wave (up until the mid-2030s.) - is based on automation of manual tasks requiring dexterity and problem-solving tasks in a dynamic real-world situation, like construction and transportation. Different countries and industries are predicted to be affected by automation to varying degrees. Financial services stand out as a sector with a high potential for automation in the first wave. It will be exposed to the application of algorithms outperforming humans in a wide range of tasks, including pure data analysis. Differences between countries' potential job automation rates are determined mainly by the structure of the national economy and average level of education, with lower rates for Nordic and some East Asian countries, which already have a relatively high level of automation, and higher rates for Eastern European countries with less advanced industrial production.

Frey and Osborne (2017) assessed what recent technological progress based on computerization and AI is likely to mean for the future of employment in the United States. They ranked and categorized occupations according to their susceptibility to automation. Using a Gaussian process classifier, they estimated the probability of computerization of 702 detailed occupations in the US. According to their estimates, around 47% of total employment is in the high-risk category, which means that they could be automated over the next decade or two. Among jobs, the most susceptible for computerization are accountants and auditors as well as bookkeeping, accounting, and auditing clerks, with an estimated probability of 0.94 and 0.98, respectively. For other professions in the financial sector, the risk seems to be lower, for example an estimated probability of 0.016 for securities, commodities, and financial services sales agents; 0.069 for financial managers; 0.23 for financial analysts; and 0.33 for financial specialists.

Moreover, the authors provided evidence that the higher the level of education, the lower the risk of computerization. The truly important factor is the nature of employment. Computer substitution is highly probable when it comes to both cognitive and manual tasks, which are routine. At the same time, non-routine tasks are very difficult to replace (Autor et al., 2003). From this perspective, proper education is very important in making the least harmful technological change for the labour market. Academic curricula should address transformations that are predicted to reshape the future labour market. Adequate preparation of future employees and constant reskilling and retraining of the existing workforce are key functions of employers and educational institutions.

Robotics is another term for technology getting attention in accounting and finance. It is a subset of AI technology and is understood as robotic automation software solutions applied to repetitive tasks in finance and accounting departments (Ashok et al., 2019). Robotic Process Automation (RPA) and Robotic Desktop Automation (RDA) are employed to facilitate the processing of sales and financial transactions, managing data, preparing financial reports, monitoring, or communicating between different systems (Seasongood, 2016). RPA is designed for repetitive tasks, and does not involve contact with customers. It enables making of credit decisions, loan or insurance underwriting, payment processing, accounting data entry, or procurement. RDA is used in retail, call centres, and other operations, where an individual employee uses a dedicated robot. The main goal is to reduce the number of simple and repetitive tasks, allowing employees to allocate more time to more advanced and complex problems. Robotics allows bookkeeping automation, especially in repetitive human activities, to ensure accuracy and communication of financial information to key stakeholders. XBRL financial reporting language is one of the examples of its application.

Machine learning is technology which emerged from AI's core (Cho et al., 2020). It allows computers to learn without being explicitly programmed (Das et al., 2015). The technology is embodied in learning algorithms, which look at the data and automatically recognize patterns and trends, find documents, retrieve and process information, index documents, determine the appropriate accounting treatment, and analyze and predict market prices. Machine learning can improve the accuracy of accounting estimates (Cho et al., 2020) and construct better models in terms of predicting financial performance and bankruptcy (Barboza et al., 2017; Qu et al., 2019). So far, at least several machine learning techniques have been applied to predict bankruptcy: multivariant discriminant analysis, logistics regression, the ensemble method, and neural networks (Qu et al., 2019). Other examples of machine learning are recommendations made by online stores like Amazon, Netflix, or Spotify (Patrick, 2020).

The Association to Advance Collegiate Schools of Business International (AACSB) and BIG-4 firms recommend integrating new technologies like Big Data or business analytics into the university curriculum (Sledgianowski et al., 2017), stating that they are crucial in audit, tax, risk management, consulting, and many more areas. The term Big Data is defined in literature through the concept of five Vs (Zhang et al., 2015). It can be decoded as massive Volume of the database, high Velocity of data added continuously, large Variety of types of data, uncertain Veracity, which addresses the issue of data accuracy and reliability, and the last one - Value, which examines the cost-benefit of collecting the data (Zhang et al., 2015). Big Data allows the designing systems of real-time financial reporting and continuous auditing. Janvrin and Watson (2017) argue that Big Data is especially important for accountants because they always try to make sense of large business data volumes, which corresponds to the anecdotal definition, which states that Big Data is "just turning a mess into meaning."

In summary, AI technologies are useful in various accounting and finance tasks like defining automatic accounting schemes, handling accounts receivables and payables, classifying accounting data, automated recording of accounting records, preparing financial reports, and auditing posted transactions and many more. Al-Htaybat et al. (2018) note that accountants, corporate managers, and regulators are no longer the only parties involved in designing finance and accounting systems. There are new augmented practices like 3D printing, which revolutionize cost accounting or blockchain technology, allowing the creation of one ledger accessible from many points within the network. AI technology is changing business models, and accounting is trying to catch up and adapt to a new situation. Krahel and Vasarhelyi (2014) note that the accounting profession is evolving from poster and preparer of information to retriever and explainer. Traditional bookkeeping is being replaced by the systematic and permanent process of understanding and concern about financial data quality and its security.

Literature provides empirical evidence that AI has a positive influence on the performance of accounting and finance systems (Chukwudi et al., 2018). In more detail, it provides empirical evidence that AI technologies help to reduce the number of mistakes in tax declarations, leading to higher tax compliance (Noga & Arnold, 2002), improve the quality of auditors' evidence processing (Rose & Rose, 2003), and help in many more ways. Bonner et al. (1996) investigate so-called decision aids, which can be treated as one of the very early AI technologies, to improve auditors' conditional probability judgment. Apostolou et al. (2019) conclude that integrating new technologies into accounting curricula is important. They advocate that universities adopt an approach based on a broader understanding of emerging AI technologies like automation, biometrics, or cybersecurity surveillance. This approach calls for a redefining of the core competencies needed in the accounting and finance professions. Finally, the accounting and finance professions have high expectations regarding newly recruited graduates, relating mainly to analytical skills, accounting information systems, big data, business data analytics and blockchain technology.

Relevant theories in the context of implementing AI technologies in the university curricula

The literature offers at least three useful theories in the context of our research problem: the unified theory of acceptance and use of technology (UTAUT), institutional theory, and the theory of technology dominance. The unified theory of acceptance and use of technology addresses the vital question in information systems research regarding how and why individuals adopt new information technologies. Venkatesh et al. (2003) developed UTAUT based on conceptual and empirical similarities across previously eight formulated prominent models in information systems acceptance research. As a result, the mentioned authors developed a unified model with four core determinants of intention and usage and up to four moderators of key relationships. Performance expectancy, effort expectancy, and social influence have been categorized as variables directly linked to behavioural intention, whereas facilitating conditions directly determine user behaviour. Moderating variables such as age, gender, experience, and voluntary use have been posited to impact users' intentions and behaviour possibly.

To sum up, UTAUT tries to explain the link between the use of technology and individuals' motives, intention, background, etc. An important premise of the theory focuses on the trade-off between effort expectation and post-implementation performance or self-efficacy. The UTAUT application is widely explored in educational studies on integrating technology as a new and effective teaching and learning delivery method (Abd Rahman et al., 2021; Suki & Suki, 2017; Wan et al., 2017). From the university perspective, the UTAUT theory may find two-fold application. Firstly, it may apply to a teaching delivery method. From this perspective, the theory may explain why using new technologies may increase the education efficacy. Secondly, it may be referred to the students' motivation to allocate their time to these courses' content, which they perceive as the most useful in their future profession. In other words, we conjecture that students perceive a trade-off between time allocated on subjects related to AI technologies and post-graduate performance (self-efficacy) as beneficial.

The institutional theory posits that institutions are founded on the "everyday activities of individuals" (Powell & Colyvas, 2008). The individual's actions are driven by structural (normative and coercive pressure) and ideational elements. In the context of the accounting and finance professions, ideational drivers refer to social responsibility. From this perspective, professionals identify themselves with the organization and society as a whole. Implementation of the technology is perceived to be in the best interest of the community. For this reason, the readiness to use the new technologies among accountants and finance professionals may be higher. Also, the awareness of social responsibility may grow with professional experience.

The theory of technology dominance, developed by Arnold and Sutton (1998), focuses on so-called intelligent decision aids (IDAs), also referred to as expert systems or intelligent systems. They are software-intensive systems that integrate the expertise of one or more experts in a given area and are intended to provide detailed recommendations or expert advice in making a decision more optimal (Arnold et al., 2004). Arnold and Sutton (1998) investigate the prerequisites of successful IDA implementation. The theory predicts individuals' tendency to reliance on IDAs' recommendations from the perspective of four factors: task experience, task complexity, the familiarity of the technology, and cognitive fit (Triki & Weisner, 2014). Arnold and Sutton (1998) postulate that the successful use of IDA recommendations has two prerequisites: the user must accept the technology, and must incorporate it into the decision-making process. According to this premise, the education of professionals plays an important role in the implementation of AI technologies, especially when familiarity with the technology is considered.

The literature presents theories offering different angles to analyze the relationship between professionals and new technologies. The first is the motivation sphere, where the UTAUT theory focuses on post-implementation benefits as opposed to the effort expectation. Secondly, the premises of institutional theory strengthen the motivation sphere through the ideational driver - the mission of the finance and accounting profession, and awareness of social responsibility. Thirdly, the theory of technology dominance points out the user-internal acceptance of the new technologies, in which university education may play an important role.

Sample selection, research design and results

We have chosen the unique Polish setting due to its favourable qualities. Firstly, Poland was the first CEE economy promoted by FTSE Russel's index provider from 'Emerging Market' to the 'Developed Market' status, illustrating the progress over time. Poland offers optimal conditions for international corporations, a good-quality institutional framework, a low level of business risk, and a labour market having well-skilled and educated professionals. At the same time, Poland still holds some characteristics typical of other emerging economies, like the lower labour cost. Secondly, Polish society is relatively young as compared to older EU members, even though the population is ageing very fast (Maj-Waśniowska & Jedynak, 2020). Despite this, the number of students and graduates in Poland is impressive. In the academic year 2020/21, there are more than 1.2 m students and around 300,000 graduates (GUS, 2021). Last but not least, Poland is also one of the world leaders in terms of providing financial outsourcing services thanks to its ability to offer well-educated graduates to international corporations (Łada et al., 2020). The market of outsourcing financial services evolved from executing the simplest accounting tasks to the present state, in which complex financial instruments are processed. The new technologies are constantly being implemented, which induces the raising of expectations of the business sector regarding the graduates' competencies. Therefore, from Poland's point of view, we can determine the utility of academic curricula from both students' and graduates' perspectives. Our study emphasizes the role of courses focusing on new technologies from the broad spectrum of artificial intelligence.

So far, academic curricula have been focused on basic computer-based courses like those teaching how to use spreadsheet software, accounting information systems (AIS), or the application of expert systems in finance. Courses including and explaining technologies like robotics, machine learning, or Big Data are still rare and occur as a novelty in the academic curricula.

We have surveyed two groups of respondents: graduate and undergraduate students enrolled at the Cracow University of Economics, located in a city known as one of the world's largest financial outsourcing services centres. The graduates of that university are sought for by large corporations and can easily find employment in an international environment, requiring technology-oriented skills and knowledge of the latest computer-based technologies. Both groups, students and graduates, are completing or have completed finance and accounting studies. Informal interviews and discussions with the students and graduates preceded the construction of the survey. This allows us, scholars teaching the course, to identify key challenges and problems in accounting and finance curricula. The survey was prepared in the google form and distributed among students and graduates in February 2021. The survey was anonymous. It consisted of multiple-choice questions, Likert scale questions, ranking questions, and open-ended questions. Overall, the survey consisted of 16 questions. The Science Club "Audit" helped us to distribute the link to students and graduates.

The students' survey results show the sample structure of which more than 70% are women, and almost 96% had already completed an internship in their field of study. Students evaluate academic curricula as good (55%) or very good (40%) and express the opinion that computer-based subjects (i.e., financial analysis using spreadsheets or information systems in finance and accounting) are useful (37%) or very useful (46%), and the time allocated to these subjects should be extended (85%). The survey shows that when they were studying students encountered one of the following terms: AI (14%), robotics (32%), machine-learning (15%), expert systems (56%), and data mining (14%).

Our graduates' survey addresses two areas: the importance of computer-based technologies in their daily work, and the evaluation of academic curricula. The graduates' survey results show the sample structure of which more than 65% are women. The results are mixed with regard to years of professional experience, where 25% are graduates completed their undergraduate studies more than ten years ago, while 20% of respondents completed their undergraduate studies one year ago. Furthermore, 35% of graduates report working in big international corporations dealing with financial services, and 22% in the big multinational corporations, while the others say that they work in another type of company or institution. Graduates evaluate academic curricula based on their working experience moderately positively (67%) or positively (15%), and only 18% of them express a moderately negative opinion. Graduates were asked which type of subjects are the most useful in their current work. The majority (90%) indicated core courses like for example International Financial Reporting Standards (IFRSs), Financial Audit, Financial Instruments, etc. 57% of respondents named computer-based subjects, while only 20% referred to topics like micro, macroeconomy or similar, and only 2% highlighted general academic courses like philosophy or ethics. Graduates report the following final grades on their diplomas: excellent (10%), very good (65%), and good (25%). They also express the need to extend the time allocated in the academic curricula to computer-based subjects.

The graduates' survey results show that almost 67% of them did not have any opportunity to learn about artificial intelligence, robotics, or data mining. In comparison, 28% learned about technologies in their work and only small fractions during the academic or post-diploma studies. Where the technologies adopted by an employer are concerned, almost 85% of graduates report that their firms are using the following as their finance tools: robotics (85%), expert systems (32%), data mining (28%), artificial intelligence (10%) and machine-learning (6%). According to most surveys, these technologies optimize the finance processes, mainly for automatic accounting records, financial analysis, and financial statements preparation. The most useful knowledge and skills in day-to-day work are robotics (63%), expert systems (44%), data mining in finance (41%), artificial intelligence (25%), and machine-learning in finance (16%). Overall, the results highlight the importance of computer-based technologies and, at the same time, insufficient academic education in this regard, which can be only partly explained by the fact that respondents graduated from university many years ago. Therefore, the insufficient academic curricula on the use of AI technologies in accounting and finance courses are not only a problem from the past, but also a challenge for the future.

The second area of our study addresses the graduates' impressions of the academic curriculum of the studies they completed. Firstly, the results show that the most useful subjects in their current profession are the core (100%) and computer-based (63%) subjects. Based on their professional experience, graduates speak of the academic curricula they followed very positively (21%) or moderately positively (63%), and (17%) moderately negatively.

Our survey of students shows that they find the following subjects most useful: expert systems in finance and accounting (56%), robotics (32%), machine-learning (15%), and data mining (14%). At the same time, most students express a willingness to allocate much more time in the academic curricula to computer-based subjects. Students report much more frequent contact with computer-based topics in their curricula as compared to graduates.

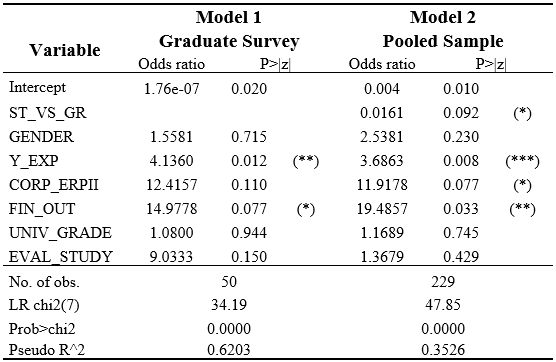

The last issue we investigate is what drives the demand for knowledge of the most advanced computer-based subject - artificial intelligence. We hypothesize that graduates with long professional experience working in the international environment are more inclined to seek knowledge on AI, which we have explored using a logit regression with an odds ratio test. Our study sample consisted of 50 responses provided by graduates. We used the following model:

Y_AIi = α0 + α1GENDER+α2Y_EXPi + +α3CORP_ERPIIi + +α4FIN_OUTi + +α5UNIV_GRADEi + +α6EVAL_STUDYi + ε

The second hypothesis addresses the difference in students' and graduates' perception regarding the importance of AI technology. To investigate the difference in the students' and graduates' perception of the explored aspect, we added the variable of students versus graduates (ST_VS_GR) and run a logit regression in a pooled sample of students and graduates, which made a total of 229 respondents. Therefore, we used the following model:

Y_AIi = α0 + α1ST_VS.GRi + α2GENDERi + α3Y_EXPi+ α4CORP_ERPIIi + α 5FIN_OUTi + α 6UNIV_GRADEi + α 7EVAL_STUDYi + ε

Where:

Y_AIi - a dichotomous variable coded as 1 when the respondent i selected AI as the priority in terms of the most useful computer-based technology required in their profession;

ST_VS_GRi - a dichotomous variable coded as 1/0 (student/graduate);

GENDERi - a dichotomous variable coded as 1/0 (female/male);

Y_EXPi - years of experience coded from 1 to 5 based on the years of professional experience (1 year or less, 1-2 years, 3-5 years, 6-10 years, 11 years or more, and zero in the case of students);

CORP_ERPIIi - graduates working in large multinational companies in which the finance/accounting departments use an ERPII system or equivalent;

FIN_OUTi - graduates working in large international corporations providing financial services (outsourcing of finance and accounting, financial instruments, etc.);

UNIV_GRADEi - the university final grade coded from 1 to 4;

EVAL_STUDYi - assessment of the academic curriculum in order from 1 (lowest grade) to 4 (highest grade).

Our findings provide empirical evidence to uphold the first hypothesis and imply that graduates with more professional experience and working in an international environment, especially in financial services sector, perceive AI as the key technology to learn. The results of the second model suggest that graduates are more inclined to learn AI technologies than students, which can be explained by the professional experience of graduates.

Table 1

Results of the logit regression with an odds ratio

Source: authors' own work.

The results of the second model based on the pooled sample of students and graduates suggest that respondents who have contact in their work with an ERPII system or equivalent are more inclined to perceive AI as a key technology to be learned. The regression results (Table 1) suggest that graduates are more willing to learn AI technologies than students (ST_VS_GR is statistically significant - p-value below 0.1 and odds ratio below 1.0). This implies that graduates are more aware and troubled by the lack of AI background. The results for the Y_EXP variable, where the p-value is statistically significant and the odds ratio above one, suggest that the more experienced the graduate is, the more they appreciate the significance of AI in academic curricula. Our findings indicate that graduates working in large multinational companies in which the finance/accounting departments use an ERPII system or equivalent, are more willing to learn AI technologies. The same interpretation applies for the FIN_OUT variable, suggesting that graduates working in large international corporations providing financial services are also more ready to learn AI.

Our study has at least several important limitations. Firstly, our sample consists of students and graduates of only one university in Poland. Secondly, more determinants affect the attitude towards AI technologies than those used in our models. Thirdly, our study is based on the opinions and impressions of the surveyed with all its limitations. In this type of questionnaire research, there is always a threat of cognitive bias. For example, the respondents will express their "internal willingness" to use modern technological solutions and not the demand from the workplace.

Discussion and conclusions

The results of our study, in general, provide a supportive argument for the UTAUT theory. Implementing AI technology is perceived to be more beneficial for graduates with more professional experience than students. The trade-off threshold is affected from both sides. Firstly, our findings imply that graduates are more aware of the benefits of AI technologies. Therefore, the perceived post-implementation performance or self-efficacy is higher, especially when based on personal experience. Secondly, we do not know which group, students or graduates, has more knowledge and competence in AI technologies. However, the informal interviews with our students and graduates lead us to conclude that the latter group has more knowledge and experience in this field. Therefore, we conjecture that the effort expectation is lower when the knowledge and skills of AI technologies are higher. However, this issue needs further investigation.

We provide further empirical evidence supporting the institutional theory in the context of new technology use. Our results support the premise that greater professional experience leads to higher social responsibility and awareness. It forms a professional attitude towards new technologies and a willingness to devote time to learning. Employee commitment is a crucial factor of success. As Alamin et al. (2020) note, the accounting profession is very specific. Accountants are unique among other corporate staff with features like community affiliation, social obligation, belief in self-regulation, autonomy demands, a constant need for education, and professional dedication. Professional accounting organizations create coercive pressure for self-development. The sense of the greater good and belief that accounting and finance professions promote are beneficial for society. These characteristics form accountants' attitudes towards new technologies. However, former education also plays an important role. AI technologies are already changing the corporations' landscape, especially in financial outsourcing services and financial departments. Universities may either stand aside or embrace the change and play an important role in shaping future generations of accountants and financial experts.

Nowadays, technological change is much less voluntary, and the digitalized environment is enforced in modern organizations. Still, resistance to change hampers the implementation of new technologies. Alamin et al. (2020) note that companies in the US reported $30 billion in unused software over four years. The worker's attitude towards new technologies may result in frustration, ambivalence and underuse. Therefore, addressing the issues of new technologies in the university curricula may solve this problem at least partially. This supposition is confirmed by the requirements of the A5 standard issued by AACSB (http://www.aacsb.edu). This standard recommends that accounting programs include learning experiences, developing skills and knowledge concerning integrating information technology in accounting and business. These technologies relate to data analytics like data management, modelling, text analysis, predictive analysis, data creation, data storage and sharing, data analytics, data mining, and data reporting. Finally, the standard calls for integrating current and emerging technologies throughout academic curricula.

Our findings also provide additional context for the theory of technology dominance. However, our research design does not allow us to address the premises of that theory directly. We can point out that there is a wide acceptance of the use of technology among students and graduates of the finance and accounting professions. We did not investigate the level of familiarity with AI technologies and how it is incorporated into the decision-making process, which is an avenue for future research. However, we expect that incorporating AI technology into the university curricula will increase the degree of ease associated with the use of new technologies.

Generally, both the surveyed groups - graduates and students alike - are convinced that computer-based courses are of importance for their future profession. In the former group, the most useful computer-based AI technologies are robotics, expert systems, and data mining in finance, while for the latter group these are expert systems in finance and accounting, robotics, and machine learning. As AI technology is the most advanced technology-based course, the surveyed graduates demonstrate more awareness of it and more demand for it, especially those working in international financial corporations providing financial outsourcing services and with a longer period of professional experience. Our study results call for a change in the academic curricula adopted in the field of finance and accounting studies. Both students and - to an even greater extent - graduates wish to see more time allocated to computer-based courses and the different scope of AI technologies. In the case of the latter group, the expectations are based on their professional experience.

Our findings and discussions with graduates lead us to conclude that two sets of skills are needed. Firstly, the core traditional knowledge of finance and accounting is required in the labour market related to double-entry bookkeeping, decision-making, or critical thinking. Secondly, the second set of skills related to new technologies is gaining in importance. This relates to skills like the ability to use new technologies, analytical capacity, and problem-solving in the computer/ internet environment.

Based on the UTAUT theory premises, we can deduce that introducing in accounting and finance studies subjects designated to AI technologies will increase the acceptance and decrease the expectation of effort related to new technologies. Secondly, based on the theory of technology dominance, we conjecture that learning AI technology at an early stage of their career allows professionals to incorporate it into the decision-making process more swiftly, which at an older age may be problematic. Finally, based on the institutional theory, we argue that subjects related to professional ethics also curtail user resistance to new technologies as long as it is perceived to be beneficial for the organization and society. Therefore, changing and adopting university curricula may be crucial for adopting new technologies in organizations.

Our results have several important implications. Firstly, our findings may motivate scholars in other fields to test whether the new AI technologies may potentially affect other professions and should be incorporated into academic education. Secondly, the findings upon university policymakers to redefine desired graduates' core competencies and skills, change university curricula, and incorporate new technologies into the teaching content and delivery methods to address the needs of the labour market. Future research should investigate in more detail which aspects of AI technologies may enrich accounting and finance courses. In this regard, it is advisable to work closely with business practice and the professional bodies like the Polish Accounting Association or the Polish Chamber of Statutory Auditors. Finally, our study identifies limitations of the academic curricula concerning the new technologies and leads us to conclude that lifetime learning is becoming a necessity of the day.

References

- Abd Rahman, S. F., Md Yunus, M., & Hashim, H. (2021). Applying UTAUT in predicting ESL lecturers intention to use flipped learning. Sustainability, 13(15), 8571. https://doi.org/10.3390/su13158571

- Alamin, A. A., Wilkin, C. L., Yeoh, W., & Warren, M. (2020). The impact of self-efficacy on accountants' behavioral intention to adopt and use accounting information systems. Journal of Information Systems, 34(3), 31-46. https://doi.org/10.2308/isys-52617

- Al-Htaybat, K., Alberti-Alhtaybat, L. von, & Alhatabat, Z. (2018). Educating digital natives for the future: accounting educators' evaluation of the accounting curriculum. Accounting Education, 27(4), 333-357. https://doi.org/10.1080/09639284.2018.1437758

- Apostolou, B., Dorminey, J. W., Hassell, J. M., & Hickey, A. (2019). Accounting education literature review (2018). Journal of Accounting Education, 47, 1-27. https://doi.org/10.1016/j.jaccedu.2019.02.001

- Arnold, V., & Sutton, S. G. (1998). The theory of technology dominance: Understanding the impact of intelligent decision aids on decision maker's judgments. Advances in Accounting Behavioral Research, 1, 175-194.

- Arnold, V., Collier, P. A., Leech, S. A., & Sutton, S.G. (2004). Impact of intelligent decision aids on expert and novice decision-makers' judgments. Accounting and Finance, 44(1), 1-26. https://doi.org/10.1111/j.1467-629x.2004.00099.x

- Ashok, M. L., Abhishek, N., & Divyashree, M. S. (2019). Emerging trends in accounting: An analysis of impact of robotics in accounting, reporting and auditing of business and financial information. International Journal of Business Analytics and Intelligence, 7(2), 28-34. https://doi.org/10.2139/ssrn.3524486

- Autor, D. H., Levy, F., & Murnane, R. J. (2003). The skill content of recent technological change: An empirical exploration. The Quarterly Journal of Economics, 118(4), 1279-1333. https://doi.org/10.1162/003355303322552801

- Barboza, F., Kimura, H., & Altman, E. (2017). Machine learning models and bankruptcy prediction. Expert Systems with Applications, 83, 405-417. https://doi.org/10.1016/j.eswa.2017.04.006

- Bonner, S. E., Libby, R., & Nelson, M. (1996). Using decision aids to improve auditors' conditional probability judgments. The Accounting Review, 71(2), 221-240. http://www.jstor.org/stable/248447

- Cho, S., Vasarhelyi, M. A., Sun, T., & Zhang, C. (2020). Learning from Machine Learning in accounting and assurance. Journal of Emerging Technologies in Accounting, 17(1), 1-10. https://doi.org/10.2308/jeta-10718

- Chukwudi, O., Echefu, S., Boniface, U., & Victoria, C. (2018). Effect of artificial intelligence on the performance of accounting operations among accounting firms in South East Nigeria. Asian Journal of Economics, Business and Accounting, 7(2), 1-11. https://doi.org/10.9734/AJEBA/2018/41641

- Das, S., Dey, A., Pal, A., & Roy, N. (2015). Applications of Artificial Intelligence in Machine Learning: Review and prospect. International Journal of Computer Applications, 115(9), 31-41. https://doi.org/10.5120/20182-2402

- Duan, Y., Edwards, J. S., & Dwivedi, Y. K. (2019). Artificial intelligence for decision making in the era of Big Data - evolution, challenges and research agenda. International Journal of Information Management, 48, 63-71. https://doi.org/10.1016/j.ijinfomgt.2019.01.021

- European Commission. (2012). Rethinking education: Investing in skills for better socio-economic outcomes. Communication from the Commission to the European Parliament Communication from the Commission to the European Parliament, the Council the European Economic and Social Committee and the Committee of the Regions. European Commission. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52012DC0669

- European Commission. (2018). Promoting the relevance of higher education. Main report. Publications Office of the European Union. https://op.europa.eu/en/publication-detail/-/publication/59d3a999-84b9-11e8-ac6a-01aa75ed71a1

- Frey, C. B., & Osborne, M. A. (2017). The future of employment: How susceptible are jobs to computerization? Technological Forecasting and Social Change, 114, 254-280. https://doi.org/10.1016/j.techfore.2016.08.019

- Goldstein, P. J. (2005, December). Academic analytics: The uses of management information and technology in higher education. Key findings. Educause Center for Applied Research. https://er.educause.edu

- GUS. (2021, June 15). Szkolnictwo wyższe w roku akademickim 2020/21 (wyniki wstępne). https://stat.gov.pl/files/gfx/portalinformacyjny/pl/defaultaktualnosci/5488/8/7/1/szkolnictwo_wyzsze_w_roku_akademickim_2020-2021.pdf

- Hawksworth, J., Berriman, R., & Goel, S. (2018). Will robots really steal our jobs? An international analysis of the potential long term impact of automation. PricewaterhouseCoopers (PwC). https://www.pwc.co.uk/economic-services/assets/international-impact-of-automation-feb-2018.pdf

- Hwang, G. J., Xie, H., Wah, B. W., & Gašević, D. (2020). Vision, challenges, roles and research issues of Artificial Intelligence in Education. Computers and Education: Artificial Intelligence, 1(1), 1-5. https://doi.org/10.1016/j.caeai.2020.100001

- Janvrin, D. J., & Weidenmier Watson, M. (2017). "Big Data": A new twist to accounting. Journal of Accounting Education, 38, 3-8. https://doi.org/10.1016/j.jaccedu.2016.12.009

- Krahel, J. P., & Vasarhelyi, M. A. (2014). AIS as facilitator of accounting change: technology, practice, and education. Journal of Information Systems, 28(2), 1-15. https://doi.org/10.2308/isys-10412

- Łada M., Konieczny A., & Wolak, J. (2020). A career in BPO and SSC Accounting Service Centers in Poland - the similarities and differences in selected aspects. The Theoretical Journal of Accounting, 106(162), 191-211.

- Maj-Waśniowska, K., & Jedynak, T. (2020). The issues and challenges of local government units in the era of population ageing. Administrative Sciences, 10(2), 1-22. https://doi.org/10.3390/admsci10020036

- Noga, T., & Arnold, V. (2002). Do tax decision support systems affect the accuracy of tax compliance decisions? International Journal of Accounting Information Systems, 3(3), 125-144. https://doi.org/10.1016/S1467-0895(02)00034-9

- OECD. (2017). In-depth analysis of the labour market relevance and outcomes of higher education systems: Analytical framework and country practices report. Enhancing higher education system performance. https://www.oecd.org/education/skills-beyond-school/LMRO%20Report.pdf

- Patrick, B. (2020, February 1). What is artificial intelligence? Journal of Accountancy. https://www.journalofaccountancy.com/issues/2020/feb/what-is-artificial-intelligence.html

- Petkov, R. (2020). Artificial Intelligence (AI) and the Accounting Function - A revisit and a new perspective for developing framework. Journal of Emerging Technologies in Accounting, 17(1), 99-105. https://doi.org/10.2308/jeta-52648

- Powell, W. W., & Colyvas, J. A. (2008). Microfoundations of institutional theory. In R. Greenwood, C. Oliver, R. Suddaby, & K. Sahlin (Eds.), The Sage Handbook of Organizational Institutionalism (pp. 276-298). SAGE Publications. https://doi.org/10.4135/9781849200387.n11

- Qu, Y., Quan, P., Lei, M., & Shi, Y. (2019). Review of bankruptcy prediction using machine learning and deep learning techniques. Procedia Computer Science, 162, 895-899. https://doi.org/10.1016/j.procs.2019.12.065

- Rose, A. M., & Rose, J. M. (2003). The effects of fraud risk assessments and a risk analysis decision aid on auditors' evaluation of evidence and judgment. Accounting Forum, 27(3), 312-338.

- Seasongood, S. (2016). Not just for the asembly line: A case for robotics in accounting and finance. Financial Executive, 32(1), 31-39. http://ksuweb.kennesaw.edu/~snorth/Robots/Articles/article4.pdf

- Sledgianowski, D., Gomaa, M., & Tan, C. (2017). Toward integration of Big Data, technology and information systems competencies into the accounting curriculum. Journal of Accounting Education, 38, 81-93. https://doi.org/10.1016/j.jaccedu.2016.12.008

- Squicciarini, M., & Nachtigall, H. (2021). Demand for AI skills in jobs: Evidence from online job postings. OECD Science, Technology and Industry Working Papers. OECD. https://doi.org/10.1787/3ed32d94-en

- Suki, N. M [Norbayah Mohd], & Suki, N. M [Norazah Mohd]. (2017). Determining students' behavioural intention to use animation and storytelling applying the UTAUT model: The moderating roles of gender and experience level. The International Journal of Management Education, 15(3), 528-538. https://doi.org/10.1016/j.ijme.2017.10.002

- Triki, A., & Weisner, M. M. (2014). Lessons from the literature on the theory of technology dominance: Possibilities for an extended research framework. Journal of Emerging Technologies in Accounting, 11(1), 41-69. https://doi.org/10.2308/jeta-51078

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: toward a unified view. MIS Quarterly, 27(3), 425-478. https://doi.org/10.2307/30036540

- Vetter, A. (2021, January 20). Embracing the AI wave. Accounting Today. https://www.accountingtoday.com/opinion/embracing-the-ai-wave

- Wan, K., Cheung, G., & Chan, K. (2017). Prediction of students' use and acceptance of clickers by learning approaches: A cross-sectional observational study. Education Sciences, 7(4), 91. https://doi.org/10.3390/educsci7040091

- Yap, A. Y., & Drye, S. L. (2018). The challenges of teaching business analytics: Finding real Big Data for business students. Information System Education Journal, 16(2), 41-50.

- Zawacki-Richter, O., Marín, V. I., Bond, M., & Gouverneur, F. (2019). Systematic review of research on artificial intelligence applications in higher education - where are the educators? International Journal of Educational Technology in Higher Education, 16 (39), 1-27. https://doi.org/10.1186/s41239-019-0171-0

- Zhang, J., Yang, X., & Appelbaum, D. (2015). Toward effective Big Data analysis in continuous auditing. Accounting Horizons, 29(2), 469-476. https://doi.org/10.2308/acch-51070

https://orcid.org/0000-0003-4425-0530

https://orcid.org/0000-0003-4425-0530